Property Information

mobile view

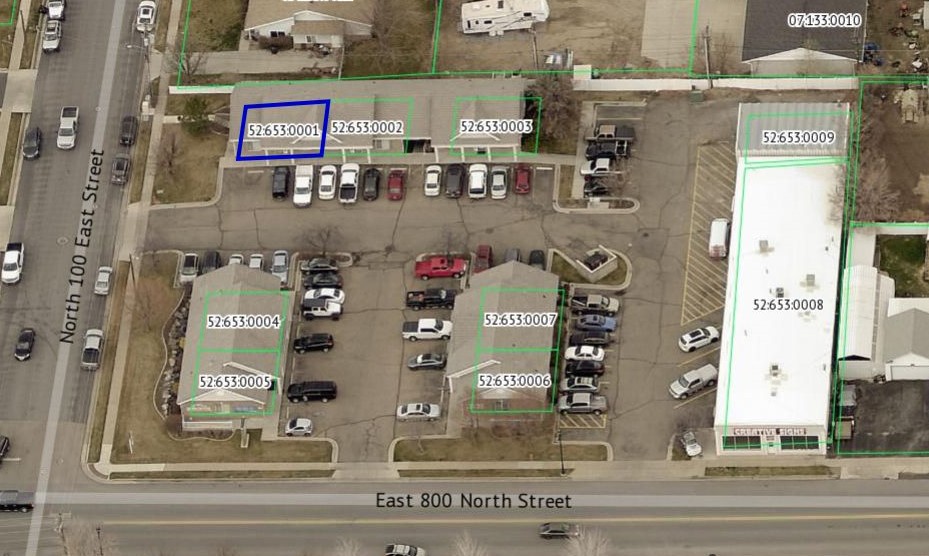

| Serial Number: 52:653:0001 |

Serial Life: 1998... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 826 N 100 EAST Unit#1 - SPANISH FORK |

|

| Mailing Address: 4114 N 200 E PROVO, UT 84604-5051 |

|

| Acreage: 0.022 |

|

| Last Document:

68105-1998

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 1, SPYGLASS PUD, PHASE 1 SUBDV. AREA 0.022 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$47,400 |

$0 |

$0 |

$47,400 |

$192,600 |

$0 |

$0 |

$192,600 |

$0 |

$0 |

$0 |

$240,000 |

| 2023 |

$46,500 |

$0 |

$0 |

$46,500 |

$189,700 |

$0 |

$0 |

$189,700 |

$0 |

$0 |

$0 |

$236,200 |

| 2022 |

$46,500 |

$0 |

$0 |

$46,500 |

$150,300 |

$0 |

$0 |

$150,300 |

$0 |

$0 |

$0 |

$196,800 |

| 2021 |

$46,500 |

$0 |

$0 |

$46,500 |

$150,300 |

$0 |

$0 |

$150,300 |

$0 |

$0 |

$0 |

$196,800 |

| 2020 |

$46,500 |

$0 |

$0 |

$46,500 |

$150,300 |

$0 |

$0 |

$150,300 |

$0 |

$0 |

$0 |

$196,800 |

| 2019 |

$40,700 |

$0 |

$0 |

$40,700 |

$116,800 |

$0 |

$0 |

$116,800 |

$0 |

$0 |

$0 |

$157,500 |

| 2018 |

$40,700 |

$0 |

$0 |

$40,700 |

$116,800 |

$0 |

$0 |

$116,800 |

$0 |

$0 |

$0 |

$157,500 |

| 2017 |

$36,800 |

$0 |

$0 |

$36,800 |

$117,700 |

$0 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$154,500 |

| 2016 |

$36,800 |

$0 |

$0 |

$36,800 |

$117,700 |

$0 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$154,500 |

| 2015 |

$36,800 |

$0 |

$0 |

$36,800 |

$117,700 |

$0 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$154,500 |

| 2014 |

$36,800 |

$0 |

$0 |

$36,800 |

$117,700 |

$0 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$154,500 |

| 2013 |

$36,800 |

$0 |

$0 |

$36,800 |

$117,700 |

$0 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$154,500 |

| 2012 |

$36,800 |

$0 |

$0 |

$36,800 |

$117,700 |

$0 |

$0 |

$117,700 |

$0 |

$0 |

$0 |

$154,500 |

| 2011 |

$37,300 |

$0 |

$0 |

$37,300 |

$127,000 |

$0 |

$0 |

$127,000 |

$0 |

$0 |

$0 |

$164,300 |

| 2010 |

$36,260 |

$0 |

$0 |

$36,260 |

$141,360 |

$0 |

$0 |

$141,360 |

$0 |

$0 |

$0 |

$177,620 |

| 2009 |

$37,000 |

$0 |

$0 |

$37,000 |

$152,000 |

$0 |

$0 |

$152,000 |

$0 |

$0 |

$0 |

$189,000 |

| 2008 |

$37,000 |

$0 |

$0 |

$37,000 |

$152,000 |

$0 |

$0 |

$152,000 |

$0 |

$0 |

$0 |

$189,000 |

| 2007 |

$31,500 |

$0 |

$0 |

$31,500 |

$118,500 |

$0 |

$0 |

$118,500 |

$0 |

$0 |

$0 |

$150,000 |

| 2006 |

$31,500 |

$0 |

$0 |

$31,500 |

$118,500 |

$0 |

$0 |

$118,500 |

$0 |

$0 |

$0 |

$150,000 |

| 2005 |

$31,500 |

$0 |

$0 |

$31,500 |

$118,500 |

$0 |

$0 |

$118,500 |

$0 |

$0 |

$0 |

$150,000 |

| 2004 |

$33,384 |

$0 |

$0 |

$33,384 |

$166,829 |

$0 |

$0 |

$166,829 |

$0 |

$0 |

$0 |

$200,213 |

| 2003 |

$33,384 |

$0 |

$0 |

$33,384 |

$126,616 |

$0 |

$0 |

$126,616 |

$0 |

$0 |

$0 |

$160,000 |

| 2002 |

$33,384 |

$0 |

$0 |

$33,384 |

$126,616 |

$0 |

$0 |

$126,616 |

$0 |

$0 |

$0 |

$160,000 |

| 2001 |

$33,384 |

$0 |

$0 |

$33,384 |

$126,616 |

$0 |

$0 |

$126,616 |

$0 |

$0 |

$0 |

$160,000 |

| 2000 |

$31,200 |

$0 |

$0 |

$31,200 |

$156,000 |

$0 |

$0 |

$156,000 |

$0 |

$0 |

$0 |

$187,200 |

| 1999 |

$31,200 |

$0 |

$0 |

$31,200 |

$156,000 |

$0 |

$0 |

$156,000 |

$0 |

$0 |

$0 |

$187,200 |

| 1998 |

$30,000 |

$0 |

$0 |

$30,000 |

$91,790 |

$0 |

$0 |

$91,790 |

$0 |

$0 |

$0 |

$121,790 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2024 |

$2,328.48 |

$0.00 |

$2,328.48 |

$0.00 |

|

|

Click for Payoff

|

150 - SPANISH FORK CITY |

| 2023 |

$2,289.01 |

$0.00 |

$2,289.01 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2022 |

$1,944.58 |

$0.00 |

$1,944.58 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2021 |

$2,210.06 |

$0.00 |

$2,210.06 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2020 |

$2,273.24 |

$0.00 |

$2,273.24 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2019 |

$1,729.19 |

$0.00 |

$1,729.19 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2018 |

$1,788.89 |

$0.00 |

$1,788.89 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2017 |

$1,795.60 |

$0.00 |

$1,795.60 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2016 |

$1,819.70 |

$0.00 |

$1,819.70 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2015 |

$1,841.64 |

$0.00 |

$1,841.64 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2014 |

$1,835.00 |

$0.00 |

$1,835.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2013 |

$1,923.83 |

$0.00 |

$1,923.83 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2012 |

$1,949.02 |

$0.00 |

$1,949.02 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2011 |

$2,026.48 |

$0.00 |

$2,026.48 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2010 |

$2,135.35 |

$0.00 |

$2,135.35 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2009 |

$2,150.82 |

$0.00 |

$2,150.82 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2008 |

$1,998.49 |

$0.00 |

$1,998.49 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2007 |

$1,589.40 |

$0.00 |

$1,589.40 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2006 |

$1,721.85 |

$0.00 |

$1,721.85 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2005 |

$1,849.05 |

$0.00 |

$1,849.05 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2004 |

$2,471.63 |

$0.00 |

$2,471.63 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2003 |

$1,785.44 |

$0.00 |

$1,785.44 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2002 |

$1,738.40 |

$0.00 |

$1,738.40 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2001 |

$1,765.44 |

$0.00 |

$1,765.44 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2000 |

$2,051.15 |

$0.00 |

$2,051.15 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 1999 |

$1,948.38 |

$0.00 |

$1,948.38 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 1998 |

$1,242.75 |

$0.00 |

$1,242.75 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 10412-2022 |

01/24/2022 |

01/25/2022 |

WD |

TUCKER, RICHARD BARTON & CHRISTINE C TEE (ET AL) |

TUCKER PROPERTY MANAGEMENT LLC |

| 49844-2019 |

05/10/2019 |

06/03/2019 |

REC |

ZIONS BANCORPORATION TEE |

SHEEN, JACK REED & BARBARA JEAN TEE (ET AL) |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 62157-2011 |

08/31/2011 |

09/02/2011 |

P REC |

ZIONS FIRST NATIONAL BANK TEE |

SHEEN, JACK REED & BARBARA JEAN |

| 25753-2010 |

03/29/2010 |

03/31/2010 |

WD |

TUCKER, RICHARD B |

TUCKER, RICHARD BARTON & CHRISTINE C TEE |

| 46634-2009 |

04/10/2009 |

04/29/2009 |

D TR |

SHEEN, JACK REED & BARBARA JEAN TEE |

ZIONS FIRST NATIONAL BANK |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 71720-2002 |

05/15/2002 |

06/25/2002 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

STONE, BRADLEY N & CAMILLE |

| 86201-1998 |

08/26/1998 |

08/27/1998 |

REC |

FAR WEST BANK TEE |

L & T CONSTRUCTION INC |

| 68105-1998 |

06/08/1998 |

07/08/1998 |

CORR AF |

FIRST AMERICAN TITLE INSURANCE COMPANY - UTAH DIVISION (ET AL) |

WHOM OF INTEREST |

| 37398-1998 |

|

04/16/1998 |

PR FNST |

MOUNTAIN AMERICA CREDIT UNION |

NAGEL, BARBARA K |

| 30549-1998 |

03/30/1998 |

03/31/1998 |

WD |

SPYGLASS PARK LC |

TUCKER, RICHARD B |

| 80700-1997 |

10/09/1997 |

10/15/1997 |

REC |

FAR WEST BANK TEE |

DICKERSON, BRUCE R |

| 56157-1997 |

07/21/1997 |

07/25/1997 |

REC |

FAR WEST BANK TEE |

DICKERSON, BRUCE R |

| 38620-1997 |

|

05/20/1997 |

FN ST |

NAGEL, BARBRA K |

MOUNTAIN AMERICA CREDIT UNION |

| 36726-1997 |

05/05/1997 |

05/13/1997 |

REC |

UNITED STATES SMALL BUSINESS ADMINISTRATION TEE |

BULLOCK ENTERPRISES INC |

| 36725-1997 |

05/05/1997 |

05/13/1997 |

SUB TEE |

UNITED STATES SMALL BUSINESS ADMINISTRATION |

UNITED STATES SMALL BUSINESS ADMINISTRATION SUCTEE |

| 30798-1997 |

03/11/1997 |

04/23/1997 |

DECLCOV |

SPYGLASS PARK LC |

WHOM OF INTEREST |

| 30797-1997 |

01/22/1997 |

04/23/1997 |

P PLAT |

SPYGLASS LC BY (ET AL) |

SPYGLASS PUD PHASE I |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/15/2024 10:40:40 PM |