Property Information

mobile view

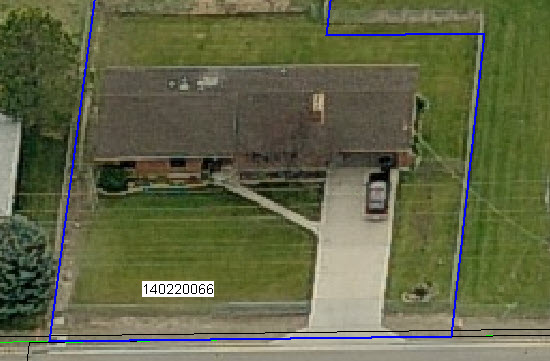

| Serial Number: 14:022:0066 |

Serial Life: 1980... |

|

|

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 1841 W 1100 NORTH - PLEASANT GROVE |

|

| Mailing Address: 350 E 2200 N NORTH LOGAN, UT 84341 |

|

| Acreage: 1.02 |

|

| Last Document:

36094-2016

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 614.93 FT & W 877.49 FT FR N 1/4 COR SEC 19, T5S, R2E, SLM; ALONGA COUNTRY ROAD N 89 15' W 100 FT; S 41' W 120 FT; S 8919'E 40 FT; S 41'E 533.99 FT S 89 19' E 60 FT; N 41' E 653.91 FT TO BEG. AREA 1.02 ACRES.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$305,800 |

$11,000 |

$316,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$316,800 |

| 2023 |

$0 |

$305,800 |

$11,000 |

$316,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$316,800 |

| 2022 |

$0 |

$322,600 |

$11,600 |

$334,200 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$334,200 |

| 2021 |

$0 |

$201,600 |

$6,100 |

$207,700 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$207,700 |

| 2020 |

$0 |

$180,000 |

$5,500 |

$185,500 |

$0 |

$214,500 |

$0 |

$214,500 |

$0 |

$0 |

$0 |

$400,000 |

| 2019 |

$0 |

$170,000 |

$2,200 |

$172,200 |

$0 |

$186,500 |

$0 |

$186,500 |

$0 |

$0 |

$0 |

$358,700 |

| 2018 |

$0 |

$150,000 |

$2,200 |

$152,200 |

$0 |

$162,200 |

$0 |

$162,200 |

$0 |

$0 |

$0 |

$314,400 |

| 2017 |

$0 |

$140,000 |

$2,200 |

$142,200 |

$0 |

$141,000 |

$0 |

$141,000 |

$0 |

$0 |

$0 |

$283,200 |

| 2016 |

$0 |

$95,000 |

$1,200 |

$96,200 |

$0 |

$122,600 |

$0 |

$122,600 |

$0 |

$0 |

$0 |

$218,800 |

| 2015 |

$0 |

$90,000 |

$1,200 |

$91,200 |

$0 |

$106,600 |

$0 |

$106,600 |

$0 |

$0 |

$0 |

$197,800 |

| 2014 |

$0 |

$90,000 |

$1,000 |

$91,000 |

$0 |

$106,600 |

$0 |

$106,600 |

$0 |

$0 |

$0 |

$197,600 |

| 2013 |

$0 |

$90,000 |

$1,800 |

$91,800 |

$0 |

$92,700 |

$0 |

$92,700 |

$0 |

$0 |

$0 |

$184,500 |

| 2012 |

$0 |

$75,000 |

$800 |

$75,800 |

$0 |

$103,000 |

$0 |

$103,000 |

$0 |

$0 |

$0 |

$178,800 |

| 2011 |

$0 |

$70,000 |

$800 |

$70,800 |

$0 |

$109,800 |

$0 |

$109,800 |

$0 |

$0 |

$0 |

$180,600 |

| 2010 |

$0 |

$88,000 |

$327 |

$88,327 |

$0 |

$107,579 |

$0 |

$107,579 |

$0 |

$0 |

$0 |

$195,906 |

| 2009 |

$0 |

$148,500 |

$35,600 |

$184,100 |

$0 |

$14,900 |

$0 |

$14,900 |

$0 |

$0 |

$0 |

$199,000 |

| 2008 |

$0 |

$188,000 |

$45,100 |

$233,100 |

$0 |

$14,900 |

$0 |

$14,900 |

$0 |

$0 |

$0 |

$248,000 |

| 2007 |

$0 |

$188,000 |

$45,100 |

$233,100 |

$0 |

$14,900 |

$0 |

$14,900 |

$0 |

$0 |

$0 |

$248,000 |

| 2006 |

$0 |

$85,000 |

$1,200 |

$86,200 |

$0 |

$129,000 |

$0 |

$129,000 |

$0 |

$0 |

$0 |

$215,200 |

| 2005 |

$0 |

$61,963 |

$1,239 |

$63,202 |

$0 |

$112,250 |

$0 |

$112,250 |

$0 |

$0 |

$0 |

$175,452 |

| 2004 |

$0 |

$61,963 |

$1,239 |

$63,202 |

$0 |

$112,250 |

$0 |

$112,250 |

$0 |

$0 |

$0 |

$175,452 |

| 2003 |

$0 |

$61,963 |

$1,239 |

$63,202 |

$0 |

$112,250 |

$0 |

$112,250 |

$0 |

$0 |

$0 |

$175,452 |

| 2002 |

$0 |

$61,963 |

$1,239 |

$63,202 |

$0 |

$112,250 |

$0 |

$112,250 |

$0 |

$0 |

$0 |

$175,452 |

| 2001 |

$0 |

$61,963 |

$1,239 |

$63,202 |

$0 |

$112,250 |

$0 |

$112,250 |

$0 |

$0 |

$0 |

$175,452 |

| 2000 |

$0 |

$57,909 |

$1,158 |

$59,067 |

$0 |

$104,956 |

$0 |

$104,956 |

$0 |

$0 |

$0 |

$164,023 |

| 1999 |

$0 |

$59,067 |

$0 |

$59,067 |

$0 |

$104,956 |

$0 |

$104,956 |

$0 |

$0 |

$0 |

$164,023 |

| 1998 |

$0 |

$52,272 |

$0 |

$52,272 |

$0 |

$92,881 |

$0 |

$92,881 |

$0 |

$0 |

$0 |

$145,153 |

| 1997 |

$0 |

$52,272 |

$0 |

$52,272 |

$0 |

$92,881 |

$0 |

$92,881 |

$0 |

$0 |

$0 |

$145,153 |

| 1996 |

$0 |

$47,798 |

$0 |

$47,798 |

$0 |

$84,931 |

$0 |

$84,931 |

$0 |

$0 |

$0 |

$132,729 |

| 1995 |

$0 |

$43,453 |

$0 |

$43,453 |

$0 |

$84,931 |

$0 |

$84,931 |

$0 |

$0 |

$0 |

$128,384 |

| 1994 |

$0 |

$25,411 |

$0 |

$25,411 |

$0 |

$68,493 |

$0 |

$68,493 |

$0 |

$0 |

$0 |

$93,904 |

| 1993 |

$0 |

$25,411 |

$0 |

$25,411 |

$0 |

$68,493 |

$0 |

$68,493 |

$0 |

$0 |

$0 |

$93,904 |

| 1992 |

$0 |

$23,313 |

$0 |

$23,313 |

$0 |

$62,838 |

$0 |

$62,838 |

$0 |

$0 |

$0 |

$86,151 |

| 1991 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$50,994 |

$0 |

$50,994 |

$0 |

$0 |

$0 |

$71,444 |

| 1990 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$50,994 |

$0 |

$50,994 |

$0 |

$0 |

$0 |

$71,444 |

| 1989 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$50,994 |

$0 |

$50,994 |

$0 |

$0 |

$0 |

$71,444 |

| 1988 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$47,675 |

$0 |

$47,675 |

$0 |

$0 |

$0 |

$68,125 |

| 1987 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$61,917 |

$0 |

$61,917 |

$0 |

$0 |

$0 |

$82,367 |

| 1986 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$61,918 |

$0 |

$61,918 |

$0 |

$0 |

$0 |

$82,368 |

| 1985 |

$0 |

$20,450 |

$0 |

$20,450 |

$0 |

$61,916 |

$0 |

$61,916 |

$0 |

$0 |

$0 |

$82,366 |

| 1984 |

$0 |

$20,658 |

$0 |

$20,658 |

$0 |

$62,542 |

$0 |

$62,542 |

$0 |

$0 |

$0 |

$83,200 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$2,714.66 |

$0.00 |

$2,714.66 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$2,593.01 |

($60.19) |

$2,532.82 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$2,749.13 |

$0.00 |

$2,749.13 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$2,040.24 |

$0.00 |

$2,040.24 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$2,229.20 |

$0.00 |

$2,229.20 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,921.09 |

$0.00 |

$1,921.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$1,782.06 |

$0.00 |

$1,782.06 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$1,659.36 |

$0.00 |

$1,659.36 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$1,325.45 |

$0.00 |

$1,325.45 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$1,265.93 |

$0.00 |

$1,265.93 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$1,275.62 |

$0.00 |

$1,275.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$1,295.85 |

$0.00 |

$1,295.85 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$1,278.26 |

$0.00 |

$1,278.26 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$1,283.41 |

$0.00 |

$1,283.41 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$1,299.70 |

$0.00 |

$1,299.70 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$1,394.10 |

$0.00 |

$1,394.10 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$1,610.20 |

$0.00 |

$1,610.20 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$1,546.42 |

$0.00 |

$1,546.42 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$1,255.94 |

$0.00 |

$1,255.94 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$1,189.43 |

$0.00 |

$1,189.43 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$1,204.38 |

$0.00 |

$1,204.38 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$1,194.38 |

$0.00 |

$1,194.38 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$1,103.25 |

$0.00 |

$1,103.25 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$1,088.88 |

$0.00 |

$1,088.88 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$1,057.41 |

$0.00 |

$1,057.41 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$1,062.89 |

$0.00 |

$1,062.89 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1998 |

$922.25 |

$0.00 |

$922.25 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1997 |

$888.96 |

$0.00 |

$888.96 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1996 |

$803.16 |

$0.00 |

$803.16 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1995 |

$873.95 |

$0.00 |

$873.95 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1994 |

$968.28 |

$0.00 |

$968.28 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1993 |

$826.90 |

$0.00 |

$826.90 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1992 |

$759.46 |

$0.00 |

$759.46 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1991 |

$666.23 |

$0.00 |

$666.23 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1990 |

$641.92 |

$0.00 |

$641.92 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1989 |

$651.69 |

$0.00 |

$651.69 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1988 |

$630.91 |

$0.00 |

$630.91 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1987 |

$752.27 |

$0.00 |

$752.27 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1986 |

$737.05 |

$0.00 |

$737.05 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1985 |

$743.47 |

$0.00 |

$743.47 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1984 |

$737.72 |

$0.00 |

$737.72 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 86407-2021 |

04/07/2021 |

05/07/2021 |

SUB AGR |

SUGARPLUM TREE LLC (ET AL) |

MAPLE SPRINGS OF PG HOLDINGS LLC (ET AL) |

| 199730-2020 |

12/15/2020 |

12/15/2020 |

REC |

ATLABANK TEE |

MAPLE SPRINGS OF PG HOLDINGS LLC |

| 196966-2020 |

11/30/2020 |

12/10/2020 |

D TR |

MAPLE SPRINGS OF PG HOLDINGS LLC |

CACHE VALLEY BANK |

| 89711-2019 |

09/09/2019 |

09/11/2019 |

TR D |

MAPLE SPRINGS OF PG HOLDINGS LLC BY (ET AL) |

SUGARPLUM TREE LLC 75%INT (ET AL) |

| 97445-2018 |

10/10/2018 |

10/10/2018 |

REC |

LEWISTON STATE BANK TEE |

MAPLE SPRINGS OF PG HOLDINGS LLC |

| 97430-2018 |

10/10/2018 |

10/10/2018 |

D TR |

MAPLE SPRINGS OF PG HOLDINGS LLC |

LEWISTON STATE BANK DIV OF (ET AL) |

| 36096-2016 |

04/22/2016 |

04/26/2016 |

D TR |

MAPLE SPRINGS OF PG HOLDINGS LLC |

LEWISTON STATE BANK |

| 36094-2016 |

04/21/2016 |

04/26/2016 |

WD |

LAMBERT, CHARLES P & BETTY A |

MAPLE SPRINGS OF PG HOLDINGS LLC |

| 27652-2014 |

04/15/2014 |

04/25/2014 |

RSUBTEE |

BANK OF NEW YORK MELLON THE (ET AL) |

LAMBERT, CHARLES P & BETTY A |

| 79986-2009 |

07/08/2009 |

07/22/2009 |

N |

PACIFI CORP |

WHOM OF INTEREST |

| 41543-2009 |

03/26/2009 |

04/17/2009 |

AS |

WILMINGTON FINANCE |

BANK OF NEW YORK MELLON THE TEE |

| 86060-2007 |

05/24/2007 |

06/13/2007 |

R/W EAS |

LAMBERT, CHARLES P & BETTY A |

PACIFI CORP DBA (ET AL) |

| 91662-2004 |

04/14/2003 |

08/10/2004 |

AS |

WILMINGTON FINANCE INC |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

| 73914-2003 |

04/23/2003 |

05/16/2003 |

RSUBTEE |

NATIONAL CITY MORTGAGE CO (ET AL) |

LAMBERT, CHARLES P & BETTY A |

| 43127-2003 |

03/17/2003 |

03/21/2003 |

D TR |

LAMBERT, CHARLES P & BETTY A |

WILMINGTON FINANCE INC |

| 41674-2002 |

04/02/2002 |

04/12/2002 |

T FN ST |

GUNTHERS COMFORT AIR |

LAMBERT, CHARLES & BETTY |

| 21847-2002 |

11/26/2001 |

02/25/2002 |

T FN ST |

GUNTHERS COMFORT AIR |

LAMBERT, CHARLES & BETTY |

| 114452-2001 |

11/01/2001 |

11/06/2001 |

REC |

SIGNATURE TITLE TEE |

LAMBERT, CHARLES P & BETTY A |

| 114451-2001 |

10/24/2001 |

11/06/2001 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

SIGNATURE TITLE SUCTEE |

| 103662-2001 |

10/04/2001 |

10/11/2001 |

REC |

SIGNATURE TITLE TEE |

LAMBERT, CHARLES P & BETTY A |

| 103661-2001 |

09/25/2001 |

10/11/2001 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

SIGNATURE TITLE SUCTEE |

| 92439-2001 |

09/07/2001 |

09/12/2001 |

AS |

GATEWAY MORTGAGE LC BY (ET AL) |

NATIONAL CITY MORTGAGE CO DBA (ET AL) |

| 92438-2001 |

09/07/2001 |

09/12/2001 |

D TR |

LAMBERT, CHARLES P & BETTY A |

GATEWAY MORTGAGE LC |

| 72221-2000 |

08/14/2000 |

09/14/2000 |

AS |

CHASE MORTGAGE COMPANY FKA (ET AL) |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

| 52709-1998 |

05/26/1998 |

05/27/1998 |

QCD |

SMITH, SCOTT LEROY (ET AL) |

PLEASANT GROVE CITY OF THE |

| 99659-1997 |

08/20/1997 |

12/16/1997 |

AS |

SOURCE ONE MORTGAGE SERVICES CORPORATION FKA (ET AL) |

CHEMICAL MORTGAGE COMPANY |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 41950-1992 |

07/30/1992 |

08/17/1992 |

EAS |

LAMBERT, CHARLES P & BETTY A |

PLEASANT GROVE CITY CORPORATION |

| 30237-1990 |

09/11/1990 |

09/13/1990 |

REL |

DESERET BANK FKA (ET AL) |

ODEKIRK, WARREN L & DOROTHY M |

| 30071-1990 |

|

09/12/1990 |

REL |

DESERET BANK FKA (ET AL) |

ODEKIRK, WARREN L & DOROTHY M |

| 28068-1987 |

05/01/1987 |

07/20/1987 |

AS |

SHEARSON LEHMAN MORTGAGE CORPORATION FKA (ET AL) |

FIREMANS FUND MORTGAGE CORPORATION |

| 26238-1980 |

07/09/1980 |

08/06/1980 |

WATERCT |

UTAH STATE OF |

BROWN, BRADLEY L |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/16/2024 2:16:58 AM |