Property Information

mobile view

| Serial Number: 14:051:0161 |

Serial Life: 2011... |

|

|

Total Photos: 6

Total Photos: 6

|

| |

|

|

| Property Address: PLEASANT GROVE |

|

| Mailing Address: 540 E 500 N PLEASANT GROVE, UT 84062-2430 |

|

| Acreage: 2.510758 |

|

| Last Document:

79648-2020

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 590.9 FT & W 89.6 FT FR N 1/4 COR. SEC. 29, T5S, R2E, SLB&M.; N 89 DEG 3' 0" W 40.4 FT; S 8 DEG 48' 1" W 85.2 FT; N 89 DEG 17' 0" W 140.66 FT; S 0 DEG 3' 20" E 2.78 FT; S 89 DEG 38' 16" W 140.36 FT; N 0 DEG 16' 49" W 5.43 FT; N 89 DEG 17' 0" W 203.95 FT; ALONG A CURVE TO L (CHORD BEARS: S 50 DEG 12' 46" E 14.32 FT, RADIUS = 1460.84 FT); N 89 DEG 38' 23" E 2.79 FT; S 52 DEG 56' 24" E 68.45 FT; S 89 DEG 43' 0" E 453.78 FT; N 7 DEG 5' 58" E 6.6 FT; N 7 DEG 6' 0" E 124.5 FT TO BEG. AREA 0.607 AC. ALSO COM S 712.71 FT & W 55.14 FT FR N 1/4 COR. SEC. 29, T5S, R2E, SLB&M.; S 88 DEG 0' 0" W 49.88 FT; S 7 DEG 5' 58" W 6.6 FT; N 89 DEG 43' 0" W 453.78 FT; S 52 DEG 56' 23" E 72.47 FT; S 37 DEG 3' 14" W 1.79 FT; ALONG A CURVE TO L (CHORD BEARS: S 60 DEG 21' 56" E 310.18 FT, RADIUS = 1851.02 FT); N 23 DEG 41' 58" E 20 FT; ALONG A CURVE TO L (CHORD BEARS: S 69 DEG 5' 0" E 262 FT, RADIUS = 1860.1 FT); N 14 DEG 57' 0" W 289.55 FT TO BEG. AREA 1.904 AC. TOTAL AREA 2.511 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

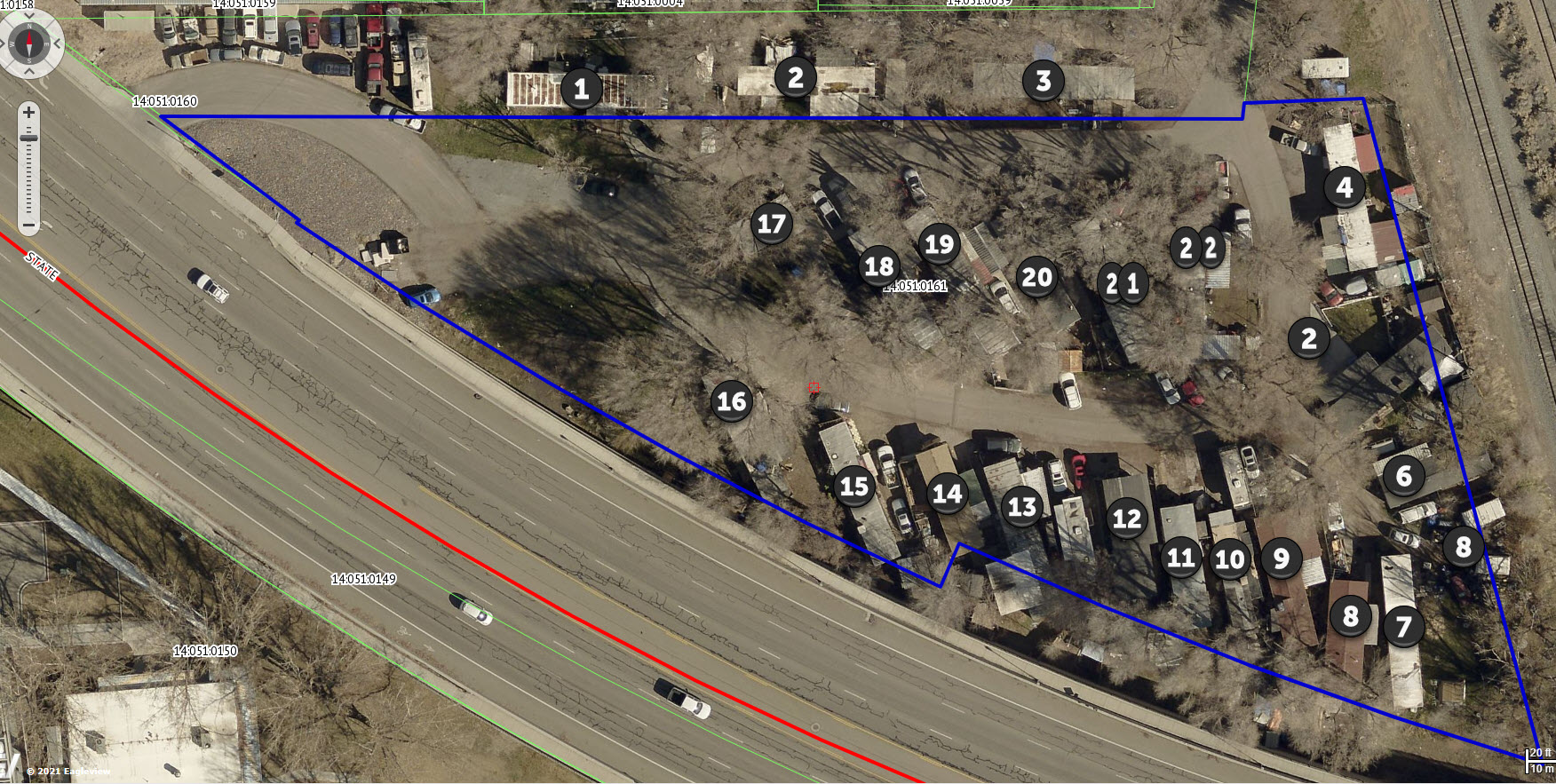

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$846,500 |

$0 |

$846,500 |

$0 |

$132,600 |

$0 |

$132,600 |

$0 |

$0 |

$0 |

$979,100 |

| 2023 |

$0 |

$935,500 |

$0 |

$935,500 |

$0 |

$126,000 |

$0 |

$126,000 |

$0 |

$0 |

$0 |

$1,061,500 |

| 2022 |

$0 |

$437,800 |

$0 |

$437,800 |

$0 |

$274,600 |

$0 |

$274,600 |

$0 |

$0 |

$0 |

$712,400 |

| 2021 |

$0 |

$728,400 |

$0 |

$728,400 |

$0 |

$41,800 |

$0 |

$41,800 |

$0 |

$0 |

$0 |

$770,200 |

| 2020 |

$0 |

$728,400 |

$0 |

$728,400 |

$0 |

$41,800 |

$0 |

$41,800 |

$0 |

$0 |

$0 |

$770,200 |

| 2019 |

$0 |

$693,400 |

$0 |

$693,400 |

$0 |

$44,600 |

$0 |

$44,600 |

$0 |

$0 |

$0 |

$738,000 |

| 2018 |

$0 |

$635,400 |

$0 |

$635,400 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$0 |

$0 |

$735,400 |

| 2017 |

$0 |

$635,400 |

$0 |

$635,400 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$0 |

$0 |

$735,400 |

| 2016 |

$0 |

$605,900 |

$0 |

$605,900 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$0 |

$0 |

$705,900 |

| 2015 |

$0 |

$577,500 |

$0 |

$577,500 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$0 |

$0 |

$677,500 |

| 2014 |

$0 |

$550,000 |

$0 |

$550,000 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$0 |

$0 |

$650,000 |

| 2013 |

$0 |

$500,000 |

$0 |

$500,000 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$0 |

$0 |

$600,000 |

| 2012 |

$0 |

$760,774 |

$0 |

$760,774 |

$0 |

$115,785 |

$0 |

$115,785 |

$0 |

$0 |

$0 |

$876,559 |

| 2011 |

$0 |

$760,774 |

$0 |

$760,774 |

$0 |

$115,785 |

$0 |

$115,785 |

$0 |

$0 |

$0 |

$876,559 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$4,614.45 |

$0.00 |

$4,614.45 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2023 |

$4,778.61 |

($110.93) |

$4,667.68 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$3,223.11 |

$0.00 |

$3,223.11 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$4,161.12 |

$0.00 |

$4,161.12 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$4,244.57 |

$0.00 |

$4,244.57 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$3,932.77 |

$0.00 |

$3,932.77 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$4,144.60 |

$0.00 |

$4,144.60 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$4,281.72 |

$0.00 |

$4,281.72 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$4,257.11 |

$0.00 |

$4,257.11 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$4,314.62 |

$0.00 |

$4,314.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$4,178.82 |

$0.00 |

$4,178.82 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$4,180.77 |

$0.00 |

$4,180.77 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$6,243.78 |

$0.00 |

$6,243.78 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$6,206.66 |

$0.00 |

$6,206.66 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 79648-2020 |

06/10/2020 |

06/10/2020 |

PERREPD |

BULLOCK, W BRENT PERREP (ET AL) |

HUTCHINGS, ROSE MARY WEST |

| 36423-2014 |

05/30/2014 |

05/30/2014 |

WD |

SORENSEN, WARREN H & DORRIS |

WEST, MARY |

| 26479-2010 |

03/15/2010 |

04/01/2010 |

EAS |

SORENSEN, WARREN H & DORRIS |

UTAH DEPARTMENT OF TRANSPORTATION |

| 26478-2010 |

|

04/01/2010 |

EAS |

SORENSEN, WARREN H & DORRIS |

UTAH DEPARTMENT OF TRANSPORTATION |

| 26477-2010 |

03/15/2010 |

04/01/2010 |

WD |

SORENSEN, WARREN H & DORRIS |

UTAH DEPARTMENT OF TRANSPORTATION |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/27/2024 9:36:40 AM |