Property Information

mobile view

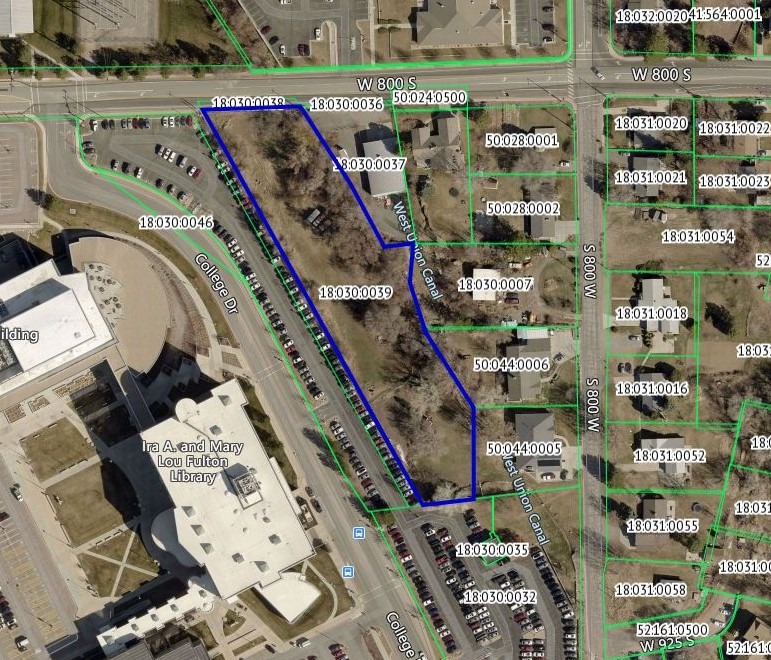

| Serial Number: 18:030:0039 |

Serial Life: 2008... |

|

|

Total Photos: 6

Total Photos: 6

|

| |

|

|

| Property Address: OREM |

|

| Mailing Address: 874 S 800 W OREM, UT 84058-6774 |

|

| Acreage: 2.009401 |

|

| Last Document:

45594-2007

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 33.21 FT & W 410.27 FT FR E 1/4 COR. SEC. 21, T6S, R2E, SLB&M.; S 32 DEG 50' 44" E 137.7 FT; S 28 DEG 16' 22" E 106.96 FT; N 83 DEG 37' 47" E 43.45 FT; S 5 DEG 4' 40" W 58.7 FT; S 17 DEG 35' 0" E 70.62 FT; S 33 DEG 9' 0" E 3.98 FT; S 89 DEG 9' 22" W 2.02 FT; S 32 DEG 23' 9" E 137.28 FT; S 0 DEG 0' 1" E 136.39 FT; S 83 DEG 34' 0" W 76.54 FT; N 29 DEG 5' 0" W 675.35 FT; N 88 DEG 4' 14" E 146.06 FT TO BEG. AREA 2.009 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$749,000 |

$0 |

$0 |

$749,000 |

$6,800 |

$0 |

$0 |

$6,800 |

$756 |

$0 |

$756 |

$755,800 |

| 2023 |

$745,500 |

$0 |

$0 |

$745,500 |

$6,200 |

$0 |

$0 |

$6,200 |

$693 |

$0 |

$693 |

$751,700 |

| 2022 |

$731,500 |

$0 |

$0 |

$731,500 |

$6,300 |

$0 |

$0 |

$6,300 |

$701 |

$0 |

$701 |

$737,800 |

| 2021 |

$693,000 |

$0 |

$0 |

$693,000 |

$7,700 |

$0 |

$0 |

$7,700 |

$687 |

$0 |

$687 |

$700,700 |

| 2020 |

$693,000 |

$0 |

$0 |

$693,000 |

$7,700 |

$0 |

$0 |

$7,700 |

$683 |

$0 |

$683 |

$700,700 |

| 2019 |

$666,400 |

$0 |

$0 |

$666,400 |

$8,800 |

$0 |

$0 |

$8,800 |

$685 |

$0 |

$685 |

$675,200 |

| 2018 |

$648,600 |

$0 |

$0 |

$648,600 |

$13,100 |

$0 |

$0 |

$13,100 |

$766 |

$0 |

$766 |

$661,700 |

| 2017 |

$618,000 |

$0 |

$0 |

$618,000 |

$13,100 |

$0 |

$0 |

$13,100 |

$802 |

$0 |

$802 |

$631,100 |

| 2016 |

$589,100 |

$0 |

$0 |

$589,100 |

$13,100 |

$0 |

$0 |

$13,100 |

$786 |

$0 |

$786 |

$602,200 |

| 2015 |

$561,100 |

$0 |

$0 |

$561,100 |

$13,100 |

$0 |

$0 |

$13,100 |

$782 |

$0 |

$782 |

$574,200 |

| 2014 |

$534,400 |

$0 |

$0 |

$534,400 |

$13,100 |

$0 |

$0 |

$13,100 |

$810 |

$0 |

$810 |

$547,500 |

| 2013 |

$485,800 |

$0 |

$0 |

$485,800 |

$13,100 |

$0 |

$0 |

$13,100 |

$858 |

$0 |

$858 |

$498,900 |

| 2012 |

$485,800 |

$0 |

$0 |

$485,800 |

$13,100 |

$0 |

$0 |

$13,100 |

$838 |

$0 |

$838 |

$498,900 |

| 2011 |

$485,800 |

$0 |

$0 |

$485,800 |

$13,100 |

$0 |

$0 |

$13,100 |

$824 |

$0 |

$824 |

$498,900 |

| 2010 |

$528,024 |

$0 |

$0 |

$528,024 |

$13,764 |

$0 |

$0 |

$13,764 |

$824 |

$0 |

$824 |

$541,788 |

| 2009 |

$538,800 |

$0 |

$0 |

$538,800 |

$14,800 |

$0 |

$0 |

$14,800 |

$804 |

$0 |

$804 |

$553,600 |

| 2008 |

$525,200 |

$0 |

$0 |

$525,200 |

$14,800 |

$0 |

$0 |

$14,800 |

$794 |

$0 |

$794 |

$540,000 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$61.79 |

$0.00 |

$61.79 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$52.45 |

$0.00 |

$52.45 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$54.99 |

$0.00 |

$54.99 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$79.07 |

$0.00 |

$79.07 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$80.42 |

$0.00 |

$80.42 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$87.50 |

$0.00 |

$87.50 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$133.88 |

$0.00 |

$133.88 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$137.81 |

$0.00 |

$137.81 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$149.27 |

$0.00 |

$149.27 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$157.80 |

$0.00 |

$157.80 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2014 |

$158.84 |

$0.00 |

$158.84 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2013 |

$171.88 |

$0.00 |

$171.88 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2012 |

$175.17 |

$0.00 |

$175.17 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2011 |

$174.16 |

$0.00 |

$174.16 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2010 |

$170.83 |

$0.00 |

$170.83 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2009 |

$169.38 |

$0.00 |

$169.38 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2008 |

$156.86 |

$0.00 |

$156.86 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 32634-2023 |

04/24/2023 |

05/22/2023 |

FARM |

QUE AND LU-LAKESHORE LLC |

WHOM OF INTEREST |

| 41589-2014 |

06/17/2014 |

06/18/2014 |

SP WD |

BRODERICK, DE RAE & DERAE (ET AL) |

BRODERICK, GARY R & CHAD S TEE |

| 41588-2014 |

06/17/2014 |

06/18/2014 |

SP WD |

BRODERICK, DE RAE & PAULINE S TEE (ET AL) |

BRODERICK, DERAE & PAULINE |

| 102479-2013 |

10/30/2013 |

11/04/2013 |

WD |

QUE AND LU-COW PASTURE LLC |

QUE AND LU-LAKESHORE LLC |

| 99557-2013 |

10/24/2013 |

10/24/2013 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 68909-2013 |

07/15/2013 |

07/17/2013 |

WD |

STEELE, LUCILE M TEE (ET AL) |

QUE AND LU-COW PASTURE LLC |

| 68908-2013 |

07/15/2013 |

07/17/2013 |

AF DC |

STEELE, ROBERT QUE & ROBERT Q AKA |

STEELE, LUCILE M TEE |

| 78213-2008 |

07/09/2008 |

07/09/2008 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 115679-2007 |

08/08/2007 |

08/08/2007 |

W FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 45594-2007 |

03/21/2007 |

03/29/2007 |

QCD |

STEELE, ROBERT QUE & LUCILE M TEE (ET AL) |

CITY OF OREM THE |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/29/2024 4:10:04 AM |