Property Information

mobile view

| Serial Number: 24:046:9604 |

Serial Life: 2007... |

|

|

Total Photos: 8

Total Photos: 8

|

| |

|

|

| Property Address: 2070 N 300 WEST - SPRINGVILLE |

|

| Mailing Address: %MURDOCK, KEN PO BOX 655 SPRINGVILLE, UT 84663-0655 |

|

| Acreage: 0 |

|

| Last Document:

176061-2006

|

|

| Subdivision Map Filing |

|

| Taxing Description:

SECTION 12 TOWNSHIP 8 S RANGE 2 E-HANGAR #79, SF-SPRINGVILLE AIRPORT(BLDG ONLY)

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

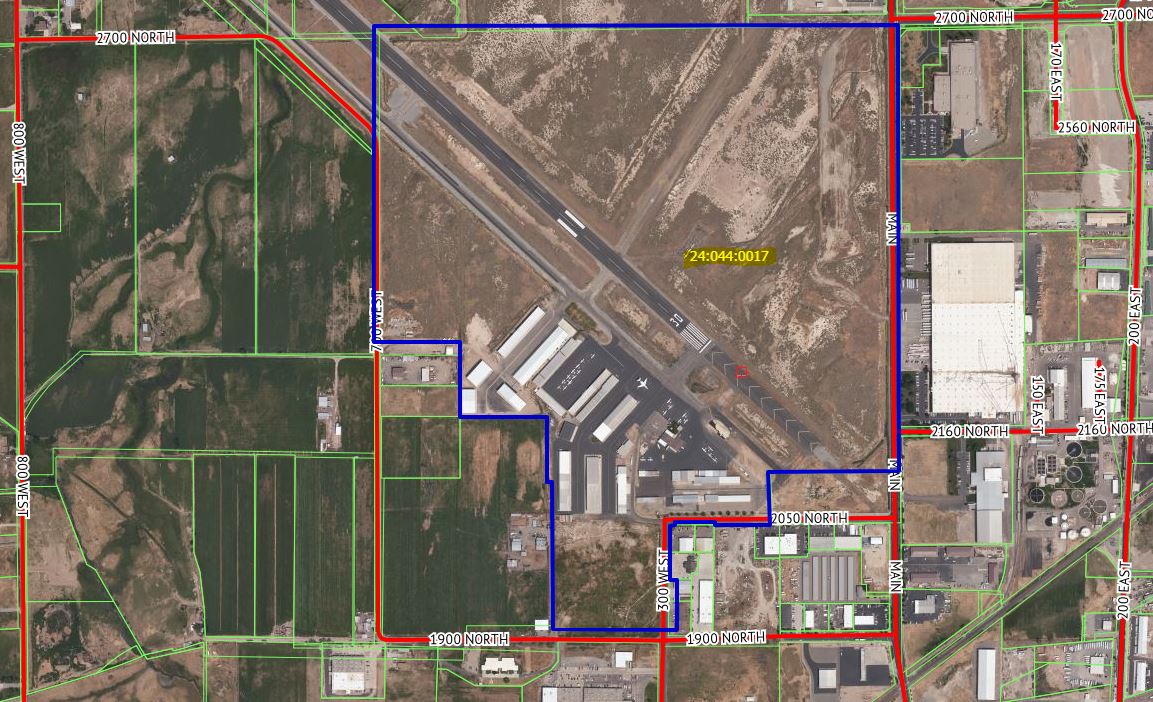

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$0 |

$0 |

$0 |

$247,300 |

$0 |

$0 |

$247,300 |

$0 |

$0 |

$0 |

$247,300 |

| 2023 |

$0 |

$0 |

$0 |

$0 |

$221,500 |

$0 |

$0 |

$221,500 |

$0 |

$0 |

$0 |

$221,500 |

| 2022 |

$0 |

$0 |

$0 |

$0 |

$200,800 |

$0 |

$0 |

$200,800 |

$0 |

$0 |

$0 |

$200,800 |

| 2021 |

$0 |

$0 |

$0 |

$0 |

$184,300 |

$0 |

$0 |

$184,300 |

$0 |

$0 |

$0 |

$184,300 |

| 2020 |

$0 |

$0 |

$0 |

$0 |

$184,300 |

$0 |

$0 |

$184,300 |

$0 |

$0 |

$0 |

$184,300 |

| 2019 |

$0 |

$0 |

$0 |

$0 |

$184,300 |

$0 |

$0 |

$184,300 |

$0 |

$0 |

$0 |

$184,300 |

| 2018 |

$0 |

$0 |

$0 |

$0 |

$167,700 |

$0 |

$0 |

$167,700 |

$0 |

$0 |

$0 |

$167,700 |

| 2017 |

$0 |

$0 |

$0 |

$0 |

$146,700 |

$0 |

$0 |

$146,700 |

$0 |

$0 |

$0 |

$146,700 |

| 2016 |

$0 |

$0 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$0 |

$139,200 |

| 2015 |

$0 |

$0 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$0 |

$139,200 |

| 2014 |

$0 |

$0 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$0 |

$139,200 |

| 2013 |

$0 |

$0 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$139,200 |

$0 |

$0 |

$0 |

$139,200 |

| 2012 |

$0 |

$0 |

$0 |

$0 |

$122,400 |

$0 |

$0 |

$122,400 |

$0 |

$0 |

$0 |

$122,400 |

| 2011 |

$0 |

$0 |

$0 |

$0 |

$122,400 |

$0 |

$0 |

$122,400 |

$0 |

$0 |

$0 |

$122,400 |

| 2010 |

$0 |

$0 |

$0 |

$0 |

$128,880 |

$0 |

$0 |

$128,880 |

$0 |

$0 |

$0 |

$128,880 |

| 2009 |

$0 |

$0 |

$0 |

$0 |

$145,500 |

$0 |

$0 |

$145,500 |

$0 |

$0 |

$0 |

$145,500 |

| 2008 |

$0 |

$0 |

$0 |

$0 |

$145,500 |

$0 |

$0 |

$145,500 |

$0 |

$0 |

$0 |

$145,500 |

| 2007 |

$0 |

$0 |

$0 |

$0 |

$138,581 |

$0 |

$0 |

$138,581 |

$0 |

$0 |

$0 |

$138,581 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2024 |

$2,413.90 |

$0.00 |

$2,413.90 |

$0.00 |

|

|

Click for Payoff

|

130 - SPRINGVILLE CITY |

| 2023 |

$2,159.85 |

$0.00 |

$2,159.85 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2022 |

$1,993.74 |

$0.00 |

$1,993.74 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2021 |

$2,137.51 |

$0.00 |

$2,137.51 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2020 |

$2,204.78 |

$0.00 |

$2,204.78 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2019 |

$2,165.71 |

$0.00 |

$2,165.71 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2018 |

$2,065.56 |

$0.00 |

$2,065.56 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2017 |

$1,871.01 |

$0.00 |

$1,871.01 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2016 |

$1,810.85 |

$0.00 |

$1,810.85 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2015 |

$1,771.32 |

$0.00 |

$1,771.32 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2014 |

$1,782.87 |

$0.00 |

$1,782.87 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2013 |

$1,863.89 |

$0.00 |

$1,863.89 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2012 |

$1,662.68 |

$0.00 |

$1,662.68 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2011 |

$1,621.92 |

$0.00 |

$1,621.92 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2010 |

$1,688.46 |

$0.00 |

$1,688.46 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2009 |

$1,723.01 |

$0.00 |

$1,723.01 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2008 |

$1,593.81 |

$0.00 |

$1,593.81 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

| 2007 |

$1,504.57 |

$0.00 |

$1,504.57 |

$0.00 |

|

$0.00

|

$0.00 |

130 - SPRINGVILLE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 176061-2006 |

12/29/2006 |

12/29/2006 |

N ABO |

WHOM OF INTEREST |

BINGHAM, MARK (ET AL) |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 10/9/2024 2:16:57 PM |