Property Information

mobile view

| Serial Number: 30:022:0004 |

Serial Life: 1989... |

|

|

Total Photos: 5

Total Photos: 5

|

| |

|

|

| Property Address: |

|

| Mailing Address: 1048 W 170 N PAYSON, UT 84651 |

|

| Acreage: 1.22 |

|

| Last Document:

12946-1988

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM S 593.79 FT & W 702.99 FT FR E 1/4 COR. SEC. 7, T9S, R2E, SLB&M.; S 2 DEG 39' 22" W 557.99 FT; S 89 DEG 10' 11" E 103.72 FT; N 1 DEG 0' 0" E 557.15 FT; N 88 DEG 48' 2" W 87.59 FT TO BEG; S 37 DEG 25' 42" W .006 FT TO BEG. AREA 1.224 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

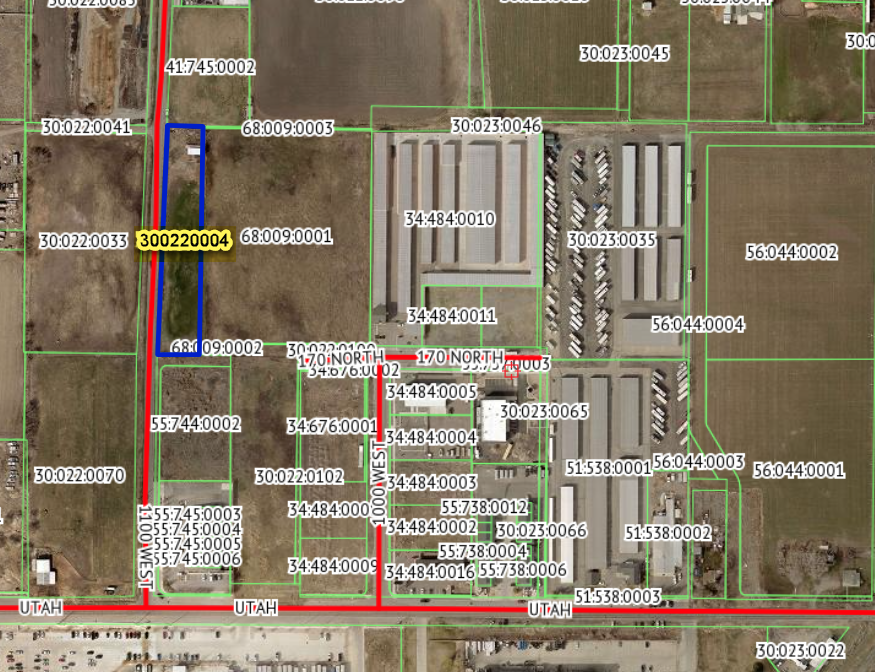

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$223,200 |

$0 |

$0 |

$223,200 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$223,200 |

| 2023 |

$217,400 |

$0 |

$0 |

$217,400 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$217,400 |

| 2022 |

$175,800 |

$0 |

$0 |

$175,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$175,800 |

| 2021 |

$146,200 |

$0 |

$0 |

$146,200 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$146,200 |

| 2020 |

$147,000 |

$0 |

$0 |

$147,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$147,000 |

| 2019 |

$142,800 |

$0 |

$0 |

$142,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$142,800 |

| 2018 |

$129,800 |

$0 |

$0 |

$129,800 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$129,800 |

| 2017 |

$96,000 |

$0 |

$0 |

$96,000 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$96,000 |

| 2016 |

$91,700 |

$0 |

$0 |

$91,700 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$91,700 |

| 2015 |

$88,500 |

$0 |

$0 |

$88,500 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$88,500 |

| 2014 |

$86,100 |

$0 |

$0 |

$86,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$86,100 |

| 2013 |

$82,026 |

$0 |

$0 |

$82,026 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$82,026 |

| 2012 |

$82,026 |

$0 |

$0 |

$82,026 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$82,026 |

| 2011 |

$82,026 |

$0 |

$0 |

$82,026 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$82,026 |

| 2010 |

$82,026 |

$0 |

$0 |

$82,026 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$82,026 |

| 2009 |

$83,700 |

$0 |

$0 |

$83,700 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$83,700 |

| 2008 |

$0 |

$0 |

$21,100 |

$21,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,100 |

| 2007 |

$0 |

$0 |

$21,100 |

$21,100 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,100 |

| 2006 |

$0 |

$0 |

$21,053 |

$21,053 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,053 |

| 2005 |

$0 |

$0 |

$21,053 |

$21,053 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,053 |

| 2004 |

$0 |

$0 |

$21,053 |

$21,053 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,053 |

| 2003 |

$0 |

$0 |

$21,053 |

$21,053 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,053 |

| 2002 |

$0 |

$0 |

$21,053 |

$21,053 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$21,053 |

| 2001 |

$0 |

$0 |

$18,307 |

$18,307 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$18,307 |

| 2000 |

$0 |

$0 |

$17,109 |

$17,109 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,109 |

| 1999 |

$0 |

$0 |

$17,109 |

$17,109 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,109 |

| 1998 |

$0 |

$0 |

$17,109 |

$17,109 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,109 |

| 1997 |

$0 |

$0 |

$17,109 |

$17,109 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,109 |

| 1996 |

$0 |

$0 |

$17,109 |

$17,109 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$17,109 |

| 1995 |

$0 |

$0 |

$15,554 |

$15,554 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$15,554 |

| 1994 |

$0 |

$0 |

$9,096 |

$9,096 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$9,096 |

| 1993 |

$0 |

$0 |

$9,096 |

$9,096 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$9,096 |

| 1992 |

$0 |

$0 |

$8,345 |

$8,345 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$8,345 |

| 1991 |

$0 |

$0 |

$7,320 |

$7,320 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$7,320 |

| 1990 |

$0 |

$0 |

$7,320 |

$7,320 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$7,320 |

| 1989 |

$0 |

$0 |

$7,320 |

$7,320 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$7,320 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2024 |

$2,193.16 |

$0.00 |

$2,193.16 |

$0.00 |

|

|

Click for Payoff

|

170 - PAYSON CITY |

| 2023 |

$2,130.30 |

$0.00 |

$2,130.30 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2022 |

$1,751.50 |

$0.00 |

$1,751.50 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2021 |

$1,651.18 |

$0.00 |

$1,651.18 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2020 |

$1,696.97 |

$0.00 |

$1,696.97 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2019 |

$1,607.93 |

$0.00 |

$1,607.93 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2018 |

$1,516.45 |

$0.00 |

$1,516.45 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2017 |

$1,146.91 |

$0.00 |

$1,146.91 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2016 |

$1,102.78 |

$0.00 |

$1,102.78 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2015 |

$1,071.65 |

$0.00 |

$1,071.65 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2014 |

$1,035.09 |

$0.00 |

$1,035.09 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2013 |

$1,032.22 |

$0.00 |

$1,032.22 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2012 |

$1,047.80 |

$0.00 |

$1,047.80 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2011 |

$1,022.95 |

$0.00 |

$1,022.95 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2010 |

$997.44 |

$0.00 |

$997.44 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2009 |

$963.97 |

$0.00 |

$963.97 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2008 |

$226.04 |

$0.00 |

$226.04 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2007 |

$224.21 |

$0.00 |

$224.21 |

$0.00 |

|

$0.00

|

$0.00 |

170 - PAYSON CITY |

| 2006 |

$264.51 |

$0.00 |

$264.51 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2005 |

$279.79 |

$0.00 |

$279.79 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2004 |

$279.75 |

$0.00 |

$279.75 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2003 |

$256.97 |

$0.00 |

$256.97 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2002 |

$250.59 |

$0.00 |

$250.59 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2001 |

$221.37 |

$0.00 |

$221.37 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2000 |

$204.02 |

$0.00 |

$204.02 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1999 |

$194.03 |

$0.00 |

$194.03 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1998 |

$191.36 |

$0.00 |

$191.36 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1997 |

$208.61 |

$0.00 |

$208.61 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1996 |

$181.78 |

$0.00 |

$181.78 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1995 |

$165.09 |

$0.00 |

$165.09 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1994 |

$120.39 |

$0.00 |

$120.39 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1993 |

$104.67 |

$0.00 |

$104.67 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1992 |

$93.15 |

$0.00 |

$93.15 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1991 |

$85.27 |

$0.00 |

$85.27 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1990 |

$77.43 |

$0.00 |

$77.43 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1989 |

$79.59 |

$0.00 |

$79.59 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 33089-2024 |

05/19/2024 |

05/20/2024 |

WD |

HARMON, BRET & BRETT AKA |

QUALITY STEEL BUILDINGS LLC |

| 10795-2021 |

01/12/2021 |

01/20/2021 |

REC |

CENTRAL BANK TEE |

HARMON, BRET |

| 104561-2016 |

10/15/2016 |

10/19/2016 |

REC |

ZB NA TEE |

HARMON, BRETT |

| 63201-2015 |

07/15/2015 |

07/15/2015 |

D TR |

HARMON, BRET |

CENTRAL BANK |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 124892-2009 |

12/03/2009 |

12/03/2009 |

EAS |

HARMON, BRETT |

PAYSON CITY |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 3837-2008 |

11/07/2007 |

01/11/2008 |

MOD AGR |

HARMON, BRETT |

ZIONS FIRST NATIONAL BANK |

| 164456-2006 |

11/28/2006 |

12/06/2006 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 164447-2006 |

12/05/2006 |

12/06/2006 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 151367-2006 |

10/18/2006 |

11/13/2006 |

ANX AGR |

PAYSON CITY (ET AL) |

WHOM OF INTEREST |

| 151366-2006 |

09/06/2006 |

11/13/2006 |

A ORDIN |

PAYSON CITY |

WHOM OF INTEREST |

| 151365-2006 |

09/06/2006 |

11/13/2006 |

A PLAT |

UTAH AVENUE WEST ANNEXATION |

PAYSON CITY |

| 132328-2006 |

10/03/2006 |

10/05/2006 |

D TR |

HARMON, BRETT |

ZIONS FIRST NATIONAL BANK |

| 132327-2006 |

10/05/2006 |

10/05/2006 |

WD |

MORTENSEN, JAMES & CAROL SUE |

HARMON, BRETT |

| 38768-2005 |

04/05/2005 |

04/12/2005 |

D TR |

DAVIS, RICHARD J & SHERYL J |

AMERICAN MORTGAGE NETWORK INC |

| 58412-2001 |

06/11/2001 |

06/14/2001 |

BLA |

HANKS, RANDY B & BRANDON R (ET AL) |

MORTENSEN, JAMES & CAROL SUE (ET AL) |

| 16150-1990 |

|

05/23/1990 |

S ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16149-1990 |

05/14/1990 |

05/23/1990 |

S ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16144-1990 |

|

05/23/1990 |

Z MAP |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16143-1990 |

|

05/23/1990 |

Z ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16142-1990 |

05/14/1990 |

05/23/1990 |

Z ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 29253-1989 |

06/08/1989 |

09/28/1989 |

EAS AGR |

MORTENSEN, JAMES & CAROL SUE |

PAYSON CITY |

| 25540-1989 |

06/14/1989 |

08/31/1989 |

EAS AGR |

MORTENSEN, JAMES A & CAROL SUE |

PAYSON CITY |

| 12946-1988 |

05/05/1988 |

05/06/1988 |

WD |

PAYSON CITY |

MORTENSEN, JAMES & CAROL SUE |

| 9590-1987 |

03/15/1987 |

03/16/1987 |

WD |

KAY, JERLIE H |

PAYSON CITY |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/10/2024 8:01:08 AM |