Property Information

mobile view

| Serial Number: 34:359:0002 |

Serial Life: 2003... |

|

|

Total Photos: 2

|

| |

|

|

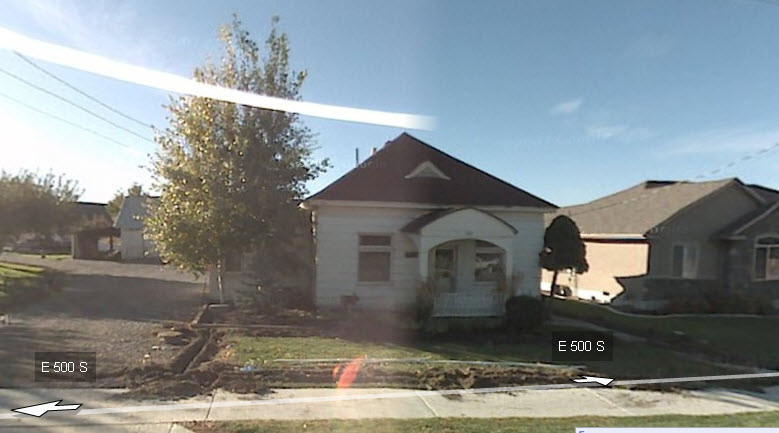

| Property Address: 452 E 500 SOUTH - PLEASANT GROVE |

|

| Mailing Address: 460 E 500 S PLEASANT GROVE, UT 84062-2918 |

|

| Acreage: 0.369 |

|

| Last Document:

129208-2002

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 2, PLAT A, ARMITSTEAD GROVE SUBDV. AREA 0.369 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$220,900 |

$0 |

$220,900 |

$0 |

$97,200 |

$0 |

$97,200 |

$0 |

$0 |

$0 |

$318,100 |

| 2023 |

$0 |

$220,900 |

$0 |

$220,900 |

$0 |

$91,200 |

$0 |

$91,200 |

$0 |

$0 |

$0 |

$312,100 |

| 2022 |

$0 |

$233,000 |

$0 |

$233,000 |

$0 |

$94,000 |

$0 |

$94,000 |

$0 |

$0 |

$0 |

$327,000 |

| 2021 |

$0 |

$166,400 |

$0 |

$166,400 |

$0 |

$68,600 |

$0 |

$68,600 |

$0 |

$0 |

$0 |

$235,000 |

| 2020 |

$0 |

$148,600 |

$0 |

$148,600 |

$0 |

$62,400 |

$0 |

$62,400 |

$0 |

$0 |

$0 |

$211,000 |

| 2019 |

$0 |

$136,500 |

$0 |

$136,500 |

$0 |

$55,900 |

$0 |

$55,900 |

$0 |

$0 |

$0 |

$192,400 |

| 2018 |

$0 |

$124,500 |

$0 |

$124,500 |

$0 |

$48,600 |

$0 |

$48,600 |

$0 |

$0 |

$0 |

$173,100 |

| 2017 |

$0 |

$104,400 |

$0 |

$104,400 |

$0 |

$47,500 |

$0 |

$47,500 |

$0 |

$0 |

$0 |

$151,900 |

| 2016 |

$0 |

$88,300 |

$0 |

$88,300 |

$0 |

$52,800 |

$0 |

$52,800 |

$0 |

$0 |

$0 |

$141,100 |

| 2015 |

$0 |

$88,300 |

$0 |

$88,300 |

$0 |

$45,900 |

$0 |

$45,900 |

$0 |

$0 |

$0 |

$134,200 |

| 2014 |

$0 |

$85,900 |

$0 |

$85,900 |

$0 |

$45,900 |

$0 |

$45,900 |

$0 |

$0 |

$0 |

$131,800 |

| 2013 |

$0 |

$59,300 |

$0 |

$59,300 |

$0 |

$45,900 |

$0 |

$45,900 |

$0 |

$0 |

$0 |

$105,200 |

| 2012 |

$0 |

$60,700 |

$0 |

$60,700 |

$0 |

$41,700 |

$0 |

$41,700 |

$0 |

$0 |

$0 |

$102,400 |

| 2011 |

$0 |

$54,300 |

$0 |

$54,300 |

$0 |

$52,300 |

$0 |

$52,300 |

$0 |

$0 |

$0 |

$106,600 |

| 2010 |

$0 |

$64,873 |

$0 |

$64,873 |

$0 |

$50,687 |

$0 |

$50,687 |

$0 |

$0 |

$0 |

$115,560 |

| 2009 |

$0 |

$91,800 |

$0 |

$91,800 |

$0 |

$28,100 |

$0 |

$28,100 |

$0 |

$0 |

$0 |

$119,900 |

| 2008 |

$0 |

$103,200 |

$0 |

$103,200 |

$0 |

$17,300 |

$0 |

$17,300 |

$0 |

$0 |

$0 |

$120,500 |

| 2007 |

$0 |

$103,200 |

$0 |

$103,200 |

$0 |

$17,300 |

$0 |

$17,300 |

$0 |

$0 |

$0 |

$120,500 |

| 2006 |

$0 |

$47,000 |

$0 |

$47,000 |

$0 |

$60,200 |

$0 |

$60,200 |

$0 |

$0 |

$0 |

$107,200 |

| 2005 |

$0 |

$47,000 |

$0 |

$47,000 |

$0 |

$30,669 |

$0 |

$30,669 |

$0 |

$0 |

$0 |

$77,669 |

| 2004 |

$0 |

$47,000 |

$0 |

$47,000 |

$0 |

$30,669 |

$0 |

$30,669 |

$0 |

$0 |

$0 |

$77,669 |

| 2003 |

$0 |

$47,000 |

$0 |

$47,000 |

$0 |

$30,669 |

$0 |

$30,669 |

$0 |

$0 |

$0 |

$77,669 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

($32.62)

|

($32.62) |

070 - PLEASANT GROVE CITY |

| 2023 |

$1,405.00 |

($32.62) |

$1,372.38 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$1,479.45 |

$0.00 |

$1,479.45 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$1,269.62 |

$0.00 |

$1,269.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$1,162.82 |

$0.00 |

$1,162.82 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,025.29 |

$0.00 |

$1,025.29 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$975.57 |

$0.00 |

$975.57 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$884.41 |

$0.00 |

$884.41 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$850.94 |

$0.00 |

$850.94 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$854.65 |

$0.00 |

$854.65 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$847.34 |

$0.00 |

$847.34 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$733.03 |

$0.00 |

$733.03 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$729.40 |

$0.00 |

$729.40 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$754.80 |

$0.00 |

$754.80 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$765.62 |

$0.00 |

$765.62 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$732.71 |

$0.00 |

$732.71 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$681.04 |

$0.00 |

$681.04 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$654.07 |

$0.00 |

$654.07 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$622.79 |

$0.00 |

$622.79 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$523.51 |

$0.00 |

$523.51 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$530.09 |

$0.00 |

$530.09 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$525.69 |

$0.00 |

$525.69 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 59087-2009 |

05/28/2009 |

05/28/2009 |

WD |

ARMITSTEAD, LYNN LLOYD & LYNN L AKA (ET AL) |

ARMITSTEAD, NEIL M & GAY B TEE |

| 44960-2003 |

03/24/2003 |

03/25/2003 |

NI |

MULTISERVE HOLDINGS LLC (ET AL) |

WHOM OF INTEREST |

| 4076-2003 |

01/07/2003 |

01/09/2003 |

PW FARM |

UTAH COUNTY ASSESSOR |

WHOM OF INTEREST |

| 129208-2002 |

09/03/2002 |

10/31/2002 |

S PLAT |

ARMITSTEAD, LLOYD & LYNN L (ET AL) |

ARMITSTEAD GROVE PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 7/8/2024 11:15:10 PM |