Property Information

mobile view

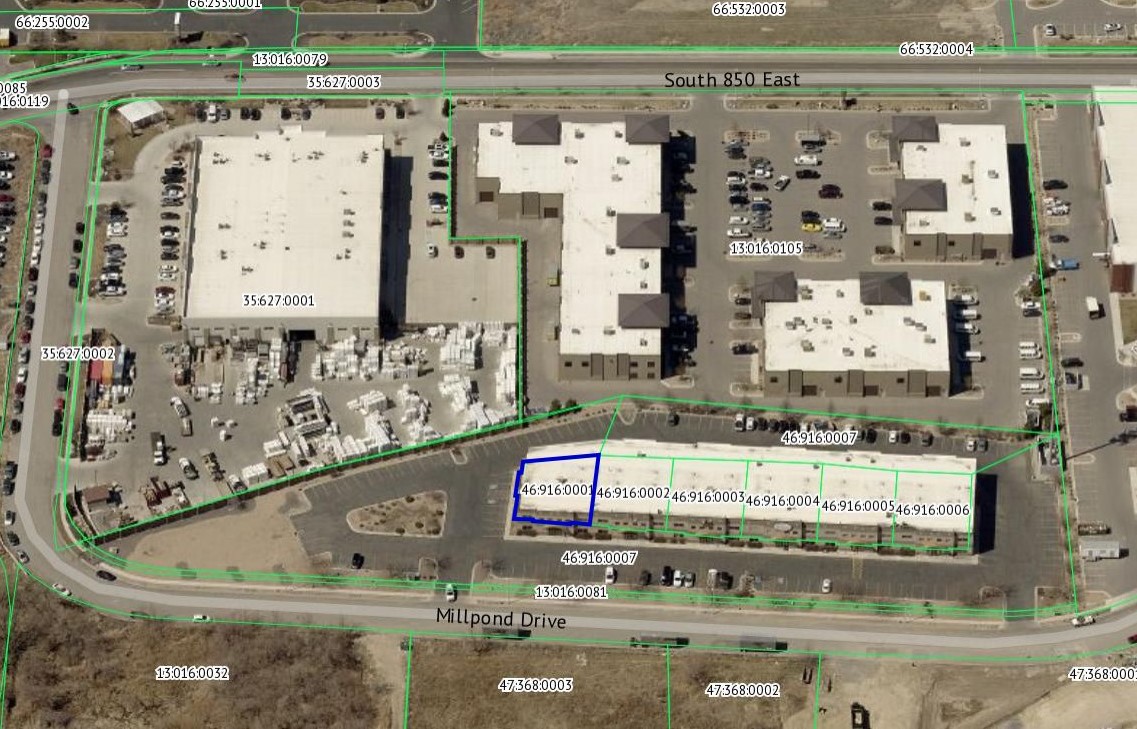

| Serial Number: 46:916:0001 |

Serial Life: 2016... |

|

|

Total Photos: 5

Total Photos: 5

|

| |

|

|

| Property Address: 400 S 1000 EAST Unit# A - LEHI |

|

| Mailing Address: 79 E EDGECOMBE DR SALT LAKE CITY, UT 84103 |

|

| Acreage: 0.116389 |

|

| Last Document:

82561-2023

|

|

| Subdivision Map Filing |

|

| Taxing Description:

UNIT A, MILL POND COMMERCIAL BUSINESS PARK SUB AREA 0.116 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$206,300 |

$0 |

$0 |

$206,300 |

$339,100 |

$0 |

$0 |

$339,100 |

$0 |

$0 |

$0 |

$545,400 |

| 2023 |

$202,300 |

$0 |

$0 |

$202,300 |

$332,400 |

$0 |

$0 |

$332,400 |

$0 |

$0 |

$0 |

$534,700 |

| 2022 |

$202,300 |

$0 |

$0 |

$202,300 |

$281,500 |

$0 |

$0 |

$281,500 |

$0 |

$0 |

$0 |

$483,800 |

| 2021 |

$202,300 |

$0 |

$0 |

$202,300 |

$281,500 |

$0 |

$0 |

$281,500 |

$0 |

$0 |

$0 |

$483,800 |

| 2020 |

$202,300 |

$0 |

$0 |

$202,300 |

$281,500 |

$0 |

$0 |

$281,500 |

$0 |

$0 |

$0 |

$483,800 |

| 2019 |

$179,800 |

$0 |

$0 |

$179,800 |

$304,000 |

$0 |

$0 |

$304,000 |

$0 |

$0 |

$0 |

$483,800 |

| 2018 |

$116,200 |

$0 |

$0 |

$116,200 |

$289,600 |

$0 |

$0 |

$289,600 |

$0 |

$0 |

$0 |

$405,800 |

| 2017 |

$116,200 |

$0 |

$0 |

$116,200 |

$289,600 |

$0 |

$0 |

$289,600 |

$0 |

$0 |

$0 |

$405,800 |

| 2016 |

$116,200 |

$0 |

$0 |

$116,200 |

$289,600 |

$0 |

$0 |

$289,600 |

$0 |

$0 |

$0 |

$405,800 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

($1,974.75)

|

($1,974.75) |

010 - LEHI CITY |

| 2024 |

$4,660.44 |

$0.00 |

$4,660.44 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2023 |

$4,208.09 |

$0.00 |

$4,208.09 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$3,927.49 |

$0.00 |

$3,927.49 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$4,723.34 |

$0.00 |

$4,723.34 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$4,778.49 |

$0.00 |

$4,778.49 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$4,596.58 |

$0.00 |

$4,596.58 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2018 |

$4,078.29 |

$0.00 |

$4,078.29 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2017 |

$4,219.10 |

$0.00 |

$4,219.10 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2016 |

$4,547.39 |

$0.00 |

$4,547.39 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 9947-2025 |

02/06/2025 |

02/11/2025 |

N RECIS |

COVENANT CLEARINGHOUSE LLC BY (ET AL) |

WHOM OF INTEREST |

| 35935-2024 |

05/31/2024 |

05/31/2024 |

COVLAND |

COVENANT CLEARINGHOUSE LLC BY (ET AL) |

WHOM OF INTEREST |

| 35677-2024 |

05/30/2024 |

05/30/2024 |

COVLAND |

COVENANT CLEARINGHOUSE LLC BY (ET AL) |

WHOM OF INTEREST |

| 82561-2023 |

12/21/2023 |

12/21/2023 |

SP WD |

BOULDEN, DOUGLAS D & JUDITH ANN TEE (ET AL) |

TRIPLE B 23 LLC |

| 140922-2021 |

07/19/2021 |

08/12/2021 |

RECIS |

FREEHOLD LICENSING INC |

FCP HOLDINGS II LLC |

| 110021-2018 |

10/23/2018 |

11/16/2018 |

ORDIN |

LEHI CITY |

WHOM OF INTEREST |

| 45711-2018 |

05/14/2018 |

05/16/2018 |

C SP WD |

BOULDEN, DOUGLAS DAVID & JUDITH ANN TEE (ET AL) |

BOULDEN, DOUGLAS D & JUDITH ANN TEE (ET AL) |

| 45710-2018 |

05/14/2018 |

05/16/2018 |

C WD |

MILL POND PARTNERS LLC 66.67%INT (ET AL) |

BOULDEN, DOUGLAS DAVID & JUDITH ANN TEE (ET AL) |

| 45674-2018 |

05/14/2018 |

05/15/2018 |

DECLCON |

MILL POND PARTNERS LLC |

WHOM OF INTEREST |

| 10057-2018 |

01/31/2018 |

01/31/2018 |

SP WD |

BOULDEN, DOUGLAS DAVID & JUDITH ANN TEE (ET AL) |

BOULDEN, DOUGLAS D & JUDITH ANN TEE (ET AL) |

| 114121-2017 |

11/10/2017 |

11/17/2017 |

ASSIGN |

FREEHOLD LICENSING INC |

FCP HOLDINGS II LLC |

| 83469-2015 |

09/02/2015 |

09/11/2015 |

REC |

BANK OF AMERICAN FORK TEE |

MILL POND PARTNERS LLC |

| 76450-2015 |

08/19/2015 |

08/21/2015 |

WD |

MILL POND PARTNERS LLC 66.67% INT (ET AL) |

BOULDEN, DOUGLAS DAVID & JUDITH ANN TEE |

| 70157-2015 |

|

08/04/2015 |

T FN ST |

U S BANK EQUIPMENT FINANCE DIV OF (ET AL) |

VERAVISTA LLC (ET AL) |

| 51884-2015 |

01/27/2015 |

06/15/2015 |

S PLAT |

MILL POND PARTNERS LLC (ET AL) |

MILL POND COMMERCIAL BUSINESS PARK |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 4/19/2025 3:33:33 AM |