Property Information

mobile view

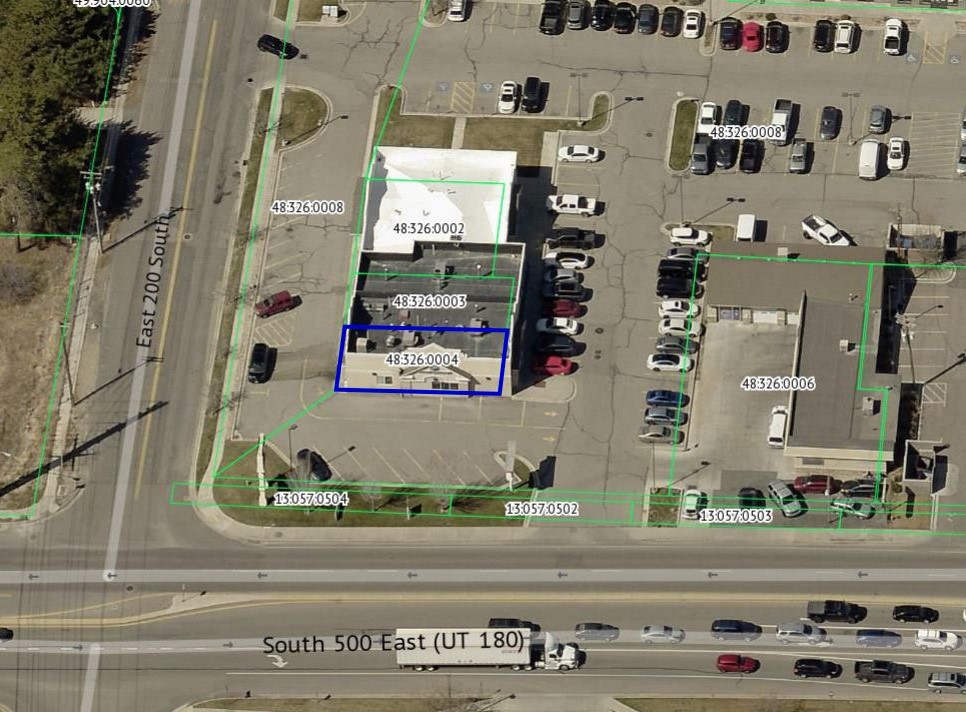

| Serial Number: 48:326:0004 |

Serial Life: 2005... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 192 S 500 EAST - AMERICAN FORK |

|

| Mailing Address: 3517 INVERNESS DR SYRACUSE, UT 84075 |

|

| Acreage: 0.044 |

|

| Last Document:

173271-2007

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 4, PLAT A, OLD TOWNE SQUARE PUD AMENDED SUBDV. AREA 0.044 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$73,600 |

$0 |

$0 |

$73,600 |

$227,300 |

$0 |

$0 |

$227,300 |

$0 |

$0 |

$0 |

$300,900 |

| 2023 |

$72,200 |

$0 |

$0 |

$72,200 |

$224,200 |

$0 |

$0 |

$224,200 |

$0 |

$0 |

$0 |

$296,400 |

| 2022 |

$72,100 |

$0 |

$0 |

$72,100 |

$203,100 |

$0 |

$0 |

$203,100 |

$0 |

$0 |

$0 |

$275,200 |

| 2021 |

$72,100 |

$0 |

$0 |

$72,100 |

$203,100 |

$0 |

$0 |

$203,100 |

$0 |

$0 |

$0 |

$275,200 |

| 2020 |

$72,100 |

$0 |

$0 |

$72,100 |

$203,100 |

$0 |

$0 |

$203,100 |

$0 |

$0 |

$0 |

$275,200 |

| 2019 |

$72,100 |

$0 |

$0 |

$72,100 |

$203,100 |

$0 |

$0 |

$203,100 |

$0 |

$0 |

$0 |

$275,200 |

| 2018 |

$72,100 |

$0 |

$0 |

$72,100 |

$179,900 |

$0 |

$0 |

$179,900 |

$0 |

$0 |

$0 |

$252,000 |

| 2017 |

$65,600 |

$0 |

$0 |

$65,600 |

$186,400 |

$0 |

$0 |

$186,400 |

$0 |

$0 |

$0 |

$252,000 |

| 2016 |

$65,600 |

$0 |

$0 |

$65,600 |

$176,300 |

$0 |

$0 |

$176,300 |

$0 |

$0 |

$0 |

$241,900 |

| 2015 |

$59,600 |

$0 |

$0 |

$59,600 |

$121,800 |

$0 |

$0 |

$121,800 |

$0 |

$0 |

$0 |

$181,400 |

| 2014 |

$59,600 |

$0 |

$0 |

$59,600 |

$121,800 |

$0 |

$0 |

$121,800 |

$0 |

$0 |

$0 |

$181,400 |

| 2013 |

$59,600 |

$0 |

$0 |

$59,600 |

$121,800 |

$0 |

$0 |

$121,800 |

$0 |

$0 |

$0 |

$181,400 |

| 2012 |

$59,600 |

$0 |

$0 |

$59,600 |

$121,800 |

$0 |

$0 |

$121,800 |

$0 |

$0 |

$0 |

$181,400 |

| 2011 |

$70,100 |

$0 |

$0 |

$70,100 |

$144,300 |

$0 |

$0 |

$144,300 |

$0 |

$0 |

$0 |

$214,400 |

| 2010 |

$95,452 |

$0 |

$0 |

$95,452 |

$181,350 |

$0 |

$0 |

$181,350 |

$0 |

$0 |

$0 |

$276,802 |

| 2009 |

$97,400 |

$0 |

$0 |

$97,400 |

$195,000 |

$0 |

$0 |

$195,000 |

$0 |

$0 |

$0 |

$292,400 |

| 2008 |

$15,800 |

$0 |

$0 |

$15,800 |

$248,200 |

$0 |

$0 |

$248,200 |

$0 |

$0 |

$0 |

$264,000 |

| 2007 |

$15,000 |

$0 |

$0 |

$15,000 |

$236,400 |

$0 |

$0 |

$236,400 |

$0 |

$0 |

$0 |

$251,400 |

| 2006 |

$12,476 |

$0 |

$0 |

$12,476 |

$214,894 |

$0 |

$0 |

$214,894 |

$0 |

$0 |

$0 |

$227,370 |

| 2005 |

$12,476 |

$0 |

$0 |

$12,476 |

$214,894 |

$0 |

$0 |

$214,894 |

$0 |

$0 |

$0 |

$227,370 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2024 |

$2,708.10 |

$0.00 |

$2,708.10 |

$0.00 |

|

|

Click for Payoff

|

060 - AMERICAN FORK CITY |

| 2023 |

$2,516.14 |

$0.00 |

$2,516.14 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2022 |

$2,367.27 |

$0.00 |

$2,367.27 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2021 |

$2,755.58 |

$0.00 |

$2,755.58 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2020 |

$2,841.16 |

$0.00 |

$2,841.16 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2019 |

$2,747.05 |

$0.00 |

$2,747.05 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2018 |

$2,630.88 |

$0.00 |

$2,630.88 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2017 |

$2,681.03 |

$0.00 |

$2,681.03 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2016 |

$2,770.00 |

$0.00 |

$2,770.00 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2015 |

$2,188.77 |

$0.00 |

$2,188.77 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2014 |

$2,218.88 |

$0.00 |

$2,218.88 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2013 |

$2,391.21 |

$0.00 |

$2,391.21 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2012 |

$2,439.47 |

$0.00 |

$2,439.47 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2011 |

$2,875.53 |

$0.00 |

$2,875.53 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2010 |

$3,485.21 |

$0.00 |

$3,485.21 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2009 |

$3,389.21 |

$0.00 |

$3,389.21 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2008 |

$2,876.54 |

$0.00 |

$2,876.54 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2007 |

$2,633.16 |

$0.00 |

$2,633.16 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2006 |

$2,560.41 |

$0.00 |

$2,560.41 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

| 2005 |

$2,769.82 |

$0.00 |

$2,769.82 |

$0.00 |

|

$0.00

|

$0.00 |

060 - AMERICAN FORK CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 13786-2017 |

02/03/2017 |

02/09/2017 |

RASSIGN |

BANK OF THE WEST |

ANDREA S INVESTMENTS LLC |

| 13785-2017 |

02/03/2017 |

02/09/2017 |

REC |

BANK OF THE WEST TEE |

ANDREAS INVESTMENTS LLC |

| 9054-2017 |

01/27/2017 |

01/27/2017 |

D TR |

Y & C INVESTMENT LLC |

BRIGHTON BANK |

| 9053-2017 |

01/26/2017 |

01/27/2017 |

SP WD |

ANDREAS INVESTMENTS LLC |

Y & C INVESTMENT LLC |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 87733-2008 |

06/23/2008 |

08/05/2008 |

AGR |

ANDREAS INVESTMENTS LLC |

BANK OF THE WEST |

| 1907-2008 |

01/02/2008 |

01/07/2008 |

R LN |

OTS LLC |

WHOM OF INTEREST |

| 173273-2007 |

12/13/2007 |

12/17/2007 |

ASSIGN |

ANDREAS INVESTMENTS LLC |

BANK OF THE WEST |

| 173272-2007 |

12/13/2007 |

12/17/2007 |

D TR |

ANDREAS INVESTMENTS LLC |

BANK OF THE WEST |

| 173271-2007 |

12/05/2007 |

12/17/2007 |

SP WD |

SAND TRAP PROPERTIES INC |

ANDREAS INVESTMENTS LLC |

| 89010-2007 |

06/19/2007 |

06/19/2007 |

NI |

OTS LLC |

WHOM OF INTEREST |

| 11707-2007 |

12/28/2005 |

01/24/2007 |

TR D |

DU JARDIN, DANA |

LE BARON, SHIRLEY |

| 164498-2006 |

12/06/2006 |

12/06/2006 |

WD |

LE BARON PROPERTIES LLC |

DU JARDIN, DANA |

| 96581-2006 |

07/06/2006 |

07/31/2006 |

AS |

DU JARDIN, DANA |

BANK OF AMERICAN FORK |

| 63101-2006 |

04/25/2006 |

05/22/2006 |

SH D |

UTAH COUNTY SHERIFF |

SAND TRAP PROPERTIES INC |

| 2662-2006 |

12/09/2005 |

01/09/2006 |

AS |

DUJARDIN, DANA |

BANK OF AMERICAN FORK |

| 2661-2006 |

12/09/2005 |

01/09/2006 |

D TR |

DU JARDIN, DANA |

BANK OF AMERICAN FORK |

| 107619-2005 |

09/08/2005 |

09/23/2005 |

CT SALE |

HMA LC (ET AL) |

COUNTY OF UTAH |

| 88703-2005 |

07/21/2005 |

08/12/2005 |

O SALE |

HMA LC (ET AL) |

U S BANK NATIONAL ASSOCIATION |

| 83754-2005 |

07/29/2005 |

08/02/2005 |

AF |

HMA LC (ET AL) |

U S BANK NATIONAL ASSOCIATION |

| 66029-2005 |

06/20/2005 |

06/20/2005 |

N LN |

HMA LC |

GUSTAFSON, ERIC |

| 64955-2005 |

03/11/2005 |

06/17/2005 |

WD |

LE BARON, SHIRLEY S |

LE BARON PROPERTIES LLC |

| 110880-2004 |

09/29/2004 |

09/29/2004 |

C WD |

HIGHLAND MANAGEMENT |

OLD TOWNE SQUARE LC |

| 109182-2004 |

09/03/2004 |

09/24/2004 |

WD |

HIGHLAND MANAGEMENT |

OLD TOWNE SQUARE LC |

| 106354-2004 |

09/16/2004 |

09/16/2004 |

ADECCOV |

LARSEN, STEPHEN |

WHOM OF INTEREST |

| 105908-2004 |

09/03/2004 |

09/15/2004 |

WD |

HIGHLAND MANAGEMENT |

OLD TOWNE SQUARE LC |

| 104279-2004 |

09/28/1999 |

09/10/2004 |

S PLAT |

HMA LLC (ET AL) |

OLD TOWNE SQUARE PUD PLAT A AMD |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/13/2024 6:30:12 PM |