Property Information

mobile view

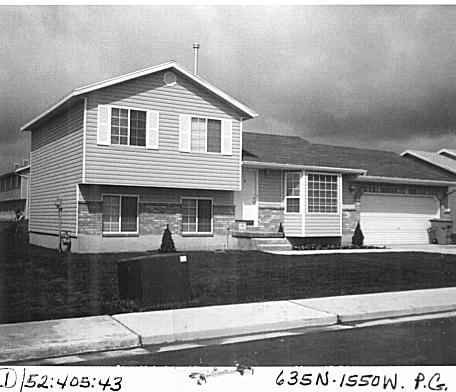

| Serial Number: 52:405:0043 |

Serial Life: 1993... |

|

|

Total Photos: 1

Total Photos: 1

|

| |

|

|

| Property Address: 635 N 1550 WEST - PLEASANT GROVE |

|

| Mailing Address: 635 N 1550 W PLEASANT GROVE, UT 84062-4061 |

|

| Acreage: 0.161 |

|

| Last Document:

12964-2002

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 43, PLAT C, STRAWBERRY POINTE. AREA 0.161 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| 2023... |

|

FALES, ALEXANDRA |

|

| 2023... |

|

FALES, MATTHEW JARED |

|

| 2020-2022 |

|

GILES, JAKE L |

|

| 2020-2022 |

|

GILES, KAYLIE |

|

| 2020NV |

|

PB & M INVESTMENTS LLC |

|

| 2016-2019 |

|

WHITE, DAVID J |

|

| 2013-2015 |

|

NIELSON, JASON H |

|

| 2004-2012 |

|

POWELL, JESSICA |

|

| 2003 |

|

MIKULECKY, JODI |

|

| 2003 |

|

MIKULECKY, MARK |

|

| 1999-2002 |

|

MIKULECKY, JODI |

|

| 1999-2002 |

|

MIKULECKY, MARK |

|

| 1995-1998 |

|

HORAN, JERILYN |

|

| 1995-1998 |

|

HORAN, MICHAEL B |

|

| 1994 |

|

HORAN, JERILYN |

|

| 1994 |

|

HORAN, MICHAEL B |

|

| 1994NV |

|

PATTERSON CONSTRUCTION INC |

|

| 1993 |

|

DALTON, ORAL T |

|

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$159,200 |

$0 |

$159,200 |

$0 |

$207,700 |

$0 |

$207,700 |

$0 |

$0 |

$0 |

$366,900 |

| 2023 |

$0 |

$159,200 |

$0 |

$159,200 |

$0 |

$209,100 |

$0 |

$209,100 |

$0 |

$0 |

$0 |

$368,300 |

| 2022 |

$0 |

$168,000 |

$0 |

$168,000 |

$0 |

$241,500 |

$0 |

$241,500 |

$0 |

$0 |

$0 |

$409,500 |

| 2021 |

$0 |

$120,000 |

$0 |

$120,000 |

$0 |

$176,300 |

$0 |

$176,300 |

$0 |

$0 |

$0 |

$296,300 |

| 2020 |

$0 |

$107,100 |

$0 |

$107,100 |

$0 |

$160,300 |

$0 |

$160,300 |

$0 |

$0 |

$0 |

$267,400 |

| 2019 |

$0 |

$97,000 |

$0 |

$97,000 |

$0 |

$139,400 |

$0 |

$139,400 |

$0 |

$0 |

$0 |

$236,400 |

| 2018 |

$0 |

$90,300 |

$0 |

$90,300 |

$0 |

$121,600 |

$0 |

$121,600 |

$0 |

$0 |

$0 |

$211,900 |

| 2017 |

$0 |

$87,000 |

$0 |

$87,000 |

$0 |

$107,800 |

$0 |

$107,800 |

$0 |

$0 |

$0 |

$194,800 |

| 2016 |

$0 |

$57,500 |

$0 |

$57,500 |

$0 |

$119,800 |

$0 |

$119,800 |

$0 |

$0 |

$0 |

$177,300 |

| 2015 |

$0 |

$55,500 |

$0 |

$55,500 |

$0 |

$119,800 |

$0 |

$119,800 |

$0 |

$0 |

$0 |

$175,300 |

| 2014 |

$0 |

$55,500 |

$0 |

$55,500 |

$0 |

$108,800 |

$0 |

$108,800 |

$0 |

$0 |

$0 |

$164,300 |

| 2013 |

$0 |

$46,300 |

$0 |

$46,300 |

$0 |

$108,800 |

$0 |

$108,800 |

$0 |

$0 |

$0 |

$155,100 |

| 2012 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$98,400 |

$0 |

$98,400 |

$0 |

$0 |

$0 |

$143,400 |

| 2011 |

$0 |

$45,000 |

$0 |

$45,000 |

$0 |

$103,700 |

$0 |

$103,700 |

$0 |

$0 |

$0 |

$148,700 |

| 2010 |

$0 |

$50,000 |

$0 |

$50,000 |

$0 |

$111,257 |

$0 |

$111,257 |

$0 |

$0 |

$0 |

$161,257 |

| 2009 |

$0 |

$79,000 |

$0 |

$79,000 |

$0 |

$84,800 |

$0 |

$84,800 |

$0 |

$0 |

$0 |

$163,800 |

| 2008 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$74,900 |

$0 |

$74,900 |

$0 |

$0 |

$0 |

$174,900 |

| 2007 |

$0 |

$100,000 |

$0 |

$100,000 |

$0 |

$74,900 |

$0 |

$74,900 |

$0 |

$0 |

$0 |

$174,900 |

| 2006 |

$0 |

$34,500 |

$0 |

$34,500 |

$0 |

$124,200 |

$0 |

$124,200 |

$0 |

$0 |

$0 |

$158,700 |

| 2005 |

$0 |

$34,512 |

$0 |

$34,512 |

$0 |

$108,083 |

$0 |

$108,083 |

$0 |

$0 |

$0 |

$142,595 |

| 2004 |

$0 |

$34,512 |

$0 |

$34,512 |

$0 |

$108,083 |

$0 |

$108,083 |

$0 |

$0 |

$0 |

$142,595 |

| 2003 |

$0 |

$34,512 |

$0 |

$34,512 |

$0 |

$108,083 |

$0 |

$108,083 |

$0 |

$0 |

$0 |

$142,595 |

| 2002 |

$0 |

$34,512 |

$0 |

$34,512 |

$0 |

$108,083 |

$0 |

$108,083 |

$0 |

$0 |

$0 |

$142,595 |

| 2001 |

$0 |

$34,512 |

$0 |

$34,512 |

$0 |

$108,083 |

$0 |

$108,083 |

$0 |

$0 |

$0 |

$142,595 |

| 2000 |

$0 |

$32,254 |

$0 |

$32,254 |

$0 |

$98,338 |

$0 |

$98,338 |

$0 |

$0 |

$0 |

$130,592 |

| 1999 |

$0 |

$32,254 |

$0 |

$32,254 |

$0 |

$98,338 |

$0 |

$98,338 |

$0 |

$0 |

$0 |

$130,592 |

| 1998 |

$0 |

$28,543 |

$0 |

$28,543 |

$0 |

$87,025 |

$0 |

$87,025 |

$0 |

$0 |

$0 |

$115,568 |

| 1997 |

$0 |

$28,543 |

$0 |

$28,543 |

$0 |

$87,025 |

$0 |

$87,025 |

$0 |

$0 |

$0 |

$115,568 |

| 1996 |

$0 |

$27,679 |

$0 |

$27,679 |

$0 |

$84,392 |

$0 |

$84,392 |

$0 |

$0 |

$0 |

$112,071 |

| 1995 |

$0 |

$25,163 |

$0 |

$25,163 |

$0 |

$84,392 |

$0 |

$84,392 |

$0 |

$0 |

$0 |

$109,555 |

| 1994 |

$0 |

$14,715 |

$0 |

$14,715 |

$0 |

$60,000 |

$0 |

$60,000 |

$0 |

$0 |

$0 |

$74,715 |

| 1993 |

$0 |

$14,715 |

$0 |

$14,715 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$14,715 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2024 |

$1,729.18 |

$0.00 |

$1,729.18 |

$0.00 |

|

|

Click for Payoff

|

070 - PLEASANT GROVE CITY |

| 2023 |

$1,657.99 |

($38.48) |

$1,619.51 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2022 |

$1,852.70 |

$0.00 |

$1,852.70 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2021 |

$1,600.81 |

$0.00 |

$1,600.81 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2020 |

$1,473.64 |

$0.00 |

$1,473.64 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2019 |

$1,259.76 |

$0.00 |

$1,259.76 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2018 |

$1,194.24 |

$0.00 |

$1,194.24 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2017 |

$1,134.18 |

$0.00 |

$1,134.18 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2016 |

$1,069.25 |

$0.00 |

$1,069.25 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2015 |

$1,116.39 |

$0.00 |

$1,116.39 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2014 |

$1,056.28 |

$0.00 |

$1,056.28 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2013 |

$1,080.73 |

$0.00 |

$1,080.73 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2012 |

$1,021.45 |

$0.00 |

$1,021.45 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2011 |

$1,052.90 |

$0.00 |

$1,052.90 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2010 |

$1,068.37 |

$0.00 |

$1,068.37 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2009 |

$1,000.99 |

$0.00 |

$1,000.99 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2008 |

$988.50 |

$0.00 |

$988.50 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2007 |

$949.35 |

$0.00 |

$949.35 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2006 |

$921.99 |

$0.00 |

$921.99 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2005 |

$961.14 |

$0.00 |

$961.14 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2004 |

$973.21 |

$0.00 |

$973.21 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2003 |

$965.13 |

$0.00 |

$965.13 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2002 |

$891.49 |

$0.00 |

$891.49 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2001 |

$879.88 |

$0.00 |

$879.88 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 2000 |

$837.06 |

$0.00 |

$837.06 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1999 |

$846.25 |

$0.00 |

$846.25 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1998 |

$734.28 |

$0.00 |

$734.28 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1997 |

$707.77 |

$0.00 |

$707.77 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1996 |

$678.15 |

$0.00 |

$678.15 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1995 |

$745.79 |

$0.00 |

$745.79 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1994 |

$770.42 |

$0.00 |

$770.42 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

| 1993 |

$183.80 |

$0.00 |

$183.80 |

$0.00 |

|

$0.00

|

$0.00 |

070 - PLEASANT GROVE CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 81829-2022 |

07/13/2022 |

07/18/2022 |

REC |

FIRST AMERICAN TITLE INSURANCE COMPANY TEE |

GILES, JAKE LYNN & JAKE L AKA (ET AL) |

| 81828-2022 |

07/05/2022 |

07/18/2022 |

SUB TEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

FIRST AMERICAN TITLE INSURANCE COMPANY SUCTEE |

| 73076-2022 |

06/21/2022 |

06/22/2022 |

D TR |

FALES, MATTHEW JARED & ALEXANDRA |

SECURITY HOME MORTGAGE LLC |

| 73075-2022 |

06/17/2022 |

06/22/2022 |

WD |

GILES, JAKE L & KAYLIE |

FALES, MATTHEW JARED & ALEXANDRA |

| 177411-2021 |

09/23/2021 |

10/18/2021 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

GILES, JAKE L & KAYLIE |

| 155999-2021 |

09/02/2021 |

09/08/2021 |

D TR |

GILES, JAKE LYNN & KAYLIE SHAE |

LOWER LLC DBA (ET AL) |

| 98648-2019 |

09/26/2019 |

09/30/2019 |

D TR |

GILES, JAKE L & KAYLIE |

SECURITYNATIONAL MORTGAGE COMPANY |

| 98573-2019 |

09/30/2019 |

09/30/2019 |

SP WD |

PB&M INVESTMENTS LLC |

GILES, JAKE L & KAYLIE |

| 20321-2019 |

03/13/2019 |

03/13/2019 |

TEE D |

ETITLE INSURANCE AGENCY TEE (ET AL) |

PB & M INVESTMENTS LLC |

| 103245-2018 |

10/26/2018 |

10/26/2018 |

ND |

ETITLE INSURANCE AGENCY TEE |

WHITE, DAVID J |

| 86085-2018 |

09/05/2018 |

09/07/2018 |

SUB TEE |

CASTLE & COOKE MORTGAGE LLC |

ETITLE INSURANCE AGENCY TEE |

| 86084-2018 |

09/05/2018 |

09/07/2018 |

AS |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC |

CASTLE & COOKE MORTGAGE LLC |

| 94684-2015 |

10/09/2015 |

10/16/2015 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

NIELSON, JASON H |

| 94683-2015 |

10/09/2015 |

10/16/2015 |

RSUBTEE |

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS INC (ET AL) |

NIELSON, JASON H |

| 65975-2015 |

07/21/2015 |

07/22/2015 |

D TR |

WHITE, DAVID J |

CASTLE & COOKE MORTGAGE LLC |

| 65974-2015 |

07/21/2015 |

07/22/2015 |

WD |

NIELSON, JASON H |

WHITE, DAVID J |

| 90850-2012 |

09/24/2012 |

10/18/2012 |

SCRIVAF |

CASTLE & COOKE MORTGAGE LLC (ET AL) |

WHOM OF INTEREST |

| 63617-2012 |

07/13/2012 |

07/31/2012 |

REC |

CITIBANK TEE |

POWELL, JESSICA |

| 63616-2012 |

07/13/2012 |

07/31/2012 |

SUB TEE |

CITIMORTGAGE INC |

CITIBANK SUCTEE |

| 41774-2012 |

05/16/2012 |

05/18/2012 |

D TR |

NIELSON, JASON H |

CASTLE & COOKE MORTGAGE LLC |

| 41773-2012 |

05/16/2012 |

05/18/2012 |

D TR |

NIELSON, JASON H |

CASTLE & COOKE MORTGAGE LLC |

| 41766-2012 |

05/16/2012 |

05/18/2012 |

WD |

POWELL, JESSICA |

NIELSON, JASON H |

| 84390-2003 |

05/09/2003 |

06/05/2003 |

REC |

MERRILL TITLE COMPANY TEE |

MIKULECKY, MARK |

| 84389-2003 |

04/15/2003 |

06/05/2003 |

SUB TEE |

M&T MORTGAGE CORPORATION |

MERRILL TITLE COMPANY SUCTEE |

| 28834-2003 |

02/11/2003 |

02/27/2003 |

REC |

US BANK TRUST COMPANY NATIONAL ASSOCIATION |

MIKULECKY, MARK & JODI |

| 15336-2003 |

01/30/2003 |

01/31/2003 |

D TR |

POWELL, JESSICA |

ABN AMRO MORTGAGE GROUP INC |

| 15335-2003 |

01/29/2003 |

01/31/2003 |

WD |

MIKULECKY, MARK & JODI |

POWELL, JESSICA |

| 31324-2002 |

03/19/2002 |

03/19/2002 |

REC |

GUARDIAN TITLE INSURANCE AGENCY OF CENTRAL UTAH INC TEE |

MIKULECKY, MARK & JODI TEE |

| 31323-2002 |

02/14/2002 |

03/19/2002 |

SUB TEE |

UNIVERSAL MORTGAGE CORPORATION TEE |

GUARDIAN TITLE INSURANCE AGENCY OF CENTRAL UTAH INC SUCTEE |

| 12965-2002 |

01/28/2002 |

02/01/2002 |

D TR |

MIKULECKY, MARK & JODI |

US BANK NATIONAL ASSOCIATION |

| 12964-2002 |

01/28/2002 |

02/01/2002 |

QCD |

MIKULECKY, MARK |

MIKULECKY, MARK & JODI |

| 12963-2002 |

01/28/2002 |

02/01/2002 |

D TR |

MIKULECKY, MARK |

M&T MORTGAGE CORPORATION |

| 12962-2002 |

01/28/2002 |

02/01/2002 |

QCD |

MIKULECKY, MARK & JODI |

MIKULECKY, MARK |

| 80242-1998 |

07/15/1998 |

08/11/1998 |

REC |

INWEST TITLE SERVICES INC SUCTEE |

HORAN, MICHAEL B & JERILYN |

| 80241-1998 |

06/26/1998 |

08/11/1998 |

SUB TEE |

UTAH HOUSING FINANCE AGENCY |

INWEST TITLE SERVICES INC SUCTEE |

| 52634-1998 |

05/22/1998 |

05/27/1998 |

D TR |

MIKULECKY, MARK & JODI |

UNIVERSAL MORTGAGE CORPORATION |

| 52633-1998 |

05/22/1998 |

05/27/1998 |

WD |

HORAN, MICHAEL B & JERILYN |

MIKULECKY, MARK & JODI |

| 76846-1995 |

11/06/1995 |

11/08/1995 |

RESOL |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 27476-1993 |

05/03/1993 |

05/04/1993 |

AS |

OLYMPUS BANK |

UTAH HOUSING FINANCE AGENCY |

| 26796-1993 |

04/29/1993 |

04/30/1993 |

D TR |

HORAN, MICHAEL B & JERILYN |

OLYMPUS BANK |

| 26795-1993 |

04/29/1993 |

04/30/1993 |

WD |

PATTERSON CONSTRUCTION (ET AL) |

HORAN, MICHAEL B & JERILYN |

| 26794-1993 |

10/20/1992 |

04/30/1993 |

WD |

DALTON ORAL T DDS DEFINED BENEFIT PENSION PLAN (ET AL) |

PATTERSON CONSTRUCTION INC |

| 51096-1992 |

09/01/1992 |

09/28/1992 |

S PLAT |

DALTON, ORAL T TEE (ET AL) |

STRAWBERRY POINTE PLAT C |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/18/2024 10:16:40 PM |