Property Information

mobile view

| Serial Number: 53:427:0302 |

Serial Life: 2009... |

|

|

Total Photos: 7

Total Photos: 7

|

| |

|

|

| Property Address: 2961 W CLUBHOUSE DR Unit#302 - LEHI |

|

| Mailing Address: %SCOTT OR JULIE WEBB PREMIER PROPERTIES 7725 N GOSHAWK RD EAGLE MOUNTAIN, UT 84005 |

|

| Acreage: 0.086 |

|

| Last Document:

134622-2008

|

|

| Subdivision Map Filing |

|

| Taxing Description:

UNIT 302, THANKSGIVING POINT NORTH CONDO PH 1. AREA 0.086 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

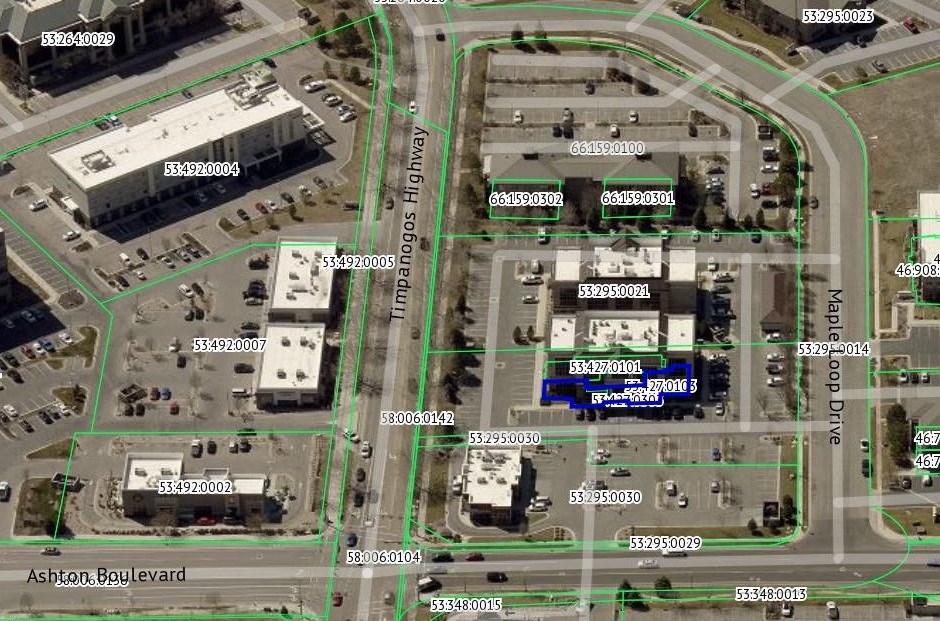

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$101,600 |

$0 |

$0 |

$101,600 |

$1,020,000 |

$0 |

$0 |

$1,020,000 |

$0 |

$0 |

$0 |

$1,121,600 |

| 2023 |

$99,600 |

$0 |

$0 |

$99,600 |

$1,000,000 |

$0 |

$0 |

$1,000,000 |

$0 |

$0 |

$0 |

$1,099,600 |

| 2022 |

$99,600 |

$0 |

$0 |

$99,600 |

$656,400 |

$0 |

$0 |

$656,400 |

$0 |

$0 |

$0 |

$756,000 |

| 2021 |

$99,600 |

$0 |

$0 |

$99,600 |

$656,400 |

$0 |

$0 |

$656,400 |

$0 |

$0 |

$0 |

$756,000 |

| 2020 |

$99,600 |

$0 |

$0 |

$99,600 |

$656,400 |

$0 |

$0 |

$656,400 |

$0 |

$0 |

$0 |

$756,000 |

| 2019 |

$99,600 |

$0 |

$0 |

$99,600 |

$656,400 |

$0 |

$0 |

$656,400 |

$0 |

$0 |

$0 |

$756,000 |

| 2018 |

$99,600 |

$0 |

$0 |

$99,600 |

$578,700 |

$0 |

$0 |

$578,700 |

$0 |

$0 |

$0 |

$678,300 |

| 2017 |

$99,600 |

$0 |

$0 |

$99,600 |

$578,800 |

$0 |

$0 |

$578,800 |

$0 |

$0 |

$0 |

$678,400 |

| 2016 |

$99,600 |

$0 |

$0 |

$99,600 |

$578,800 |

$0 |

$0 |

$578,800 |

$0 |

$0 |

$0 |

$678,400 |

| 2015 |

$99,600 |

$0 |

$0 |

$99,600 |

$578,800 |

$0 |

$0 |

$578,800 |

$0 |

$0 |

$0 |

$678,400 |

| 2014 |

$99,600 |

$0 |

$0 |

$99,600 |

$578,800 |

$0 |

$0 |

$578,800 |

$0 |

$0 |

$0 |

$678,400 |

| 2013 |

$99,600 |

$0 |

$0 |

$99,600 |

$454,000 |

$0 |

$0 |

$454,000 |

$0 |

$0 |

$0 |

$553,600 |

| 2012 |

$99,600 |

$0 |

$0 |

$99,600 |

$454,000 |

$0 |

$0 |

$454,000 |

$0 |

$0 |

$0 |

$553,600 |

| 2011 |

$99,000 |

$0 |

$0 |

$99,000 |

$494,800 |

$0 |

$0 |

$494,800 |

$0 |

$0 |

$0 |

$593,800 |

| 2010 |

$107,586 |

$0 |

$0 |

$107,586 |

$520,818 |

$0 |

$0 |

$520,818 |

$0 |

$0 |

$0 |

$628,404 |

| 2009 |

$107,600 |

$0 |

$0 |

$107,600 |

$399,900 |

$0 |

$0 |

$399,900 |

$0 |

$0 |

$0 |

$507,500 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2023 |

$8,653.85 |

$0.00 |

$8,653.85 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$6,137.21 |

$0.00 |

$6,137.21 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$7,380.83 |

$0.00 |

$7,380.83 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$7,467.01 |

$0.00 |

$7,467.01 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$7,182.76 |

$0.00 |

$7,182.76 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2018 |

$6,816.92 |

$0.00 |

$6,816.92 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2017 |

$7,053.32 |

$0.00 |

$7,053.32 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2016 |

$7,602.15 |

$0.00 |

$7,602.15 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2015 |

$8,008.51 |

$0.00 |

$8,008.51 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2014 |

$8,056.00 |

$0.00 |

$8,056.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2013 |

$7,128.15 |

$0.00 |

$7,128.15 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2012 |

$7,326.34 |

$0.00 |

$7,326.34 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2011 |

$7,808.47 |

$0.00 |

$7,808.47 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2010 |

$7,756.39 |

$0.00 |

$7,756.39 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2009 |

$5,565.25 |

$0.00 |

$5,565.25 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 134623-2008 |

12/10/2008 |

12/29/2008 |

DECLCON |

POC DEVELOPMENT LLC |

WHOM OF INTEREST |

| 134622-2008 |

10/14/2008 |

12/29/2008 |

C PLAT |

POC DEVELOPMENT LLC |

THANKSGIVING POINT NORTH CONDOMINIUMS PHASE 1 |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 9/5/2024 5:26:49 PM |