Property Information

mobile view

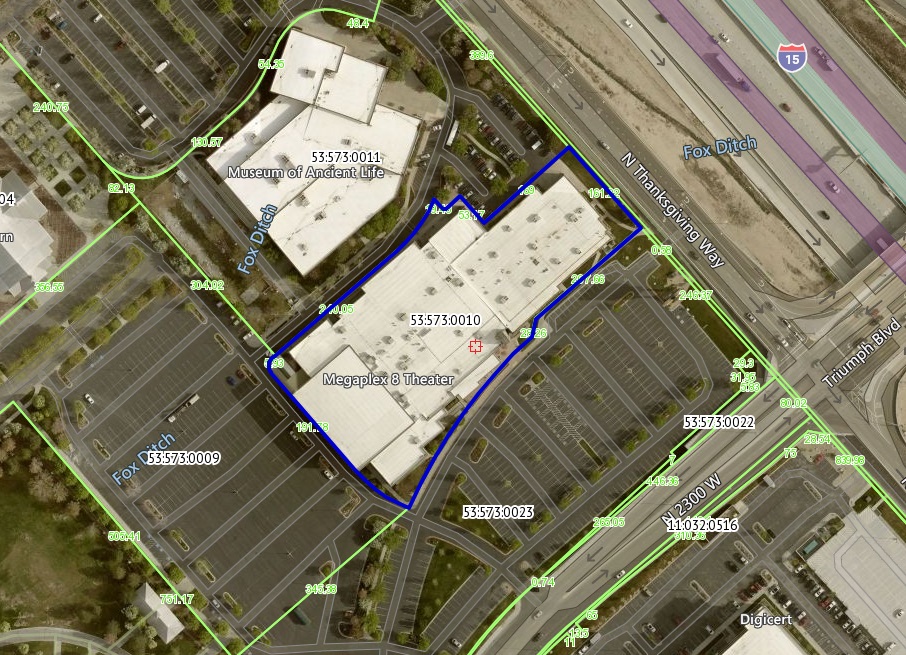

| Serial Number: 53:573:0010 |

Serial Life: 2019... |

|

|

Total Photos: 11

Total Photos: 11

|

| |

|

|

| Property Address: 2935 N THANKSGIVING WAY - LEHI |

|

| Mailing Address: 3200 W CLUBHOUSE DR STE 200 LEHI, UT 84043 |

|

| Acreage: 2.851199 |

|

| Last Document:

91822-2018

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 10, PLAT G, THANKSGIVING POINT AMD SUB AREA 2.851 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$2,359,500 |

$0 |

$0 |

$2,359,500 |

$24,950,700 |

$0 |

$0 |

$24,950,700 |

$0 |

$0 |

$0 |

$27,310,200 |

| 2023 |

$2,225,400 |

$0 |

$0 |

$2,225,400 |

$18,360,000 |

$0 |

$0 |

$18,360,000 |

$0 |

$0 |

$0 |

$20,585,400 |

| 2022 |

$1,800,000 |

$0 |

$0 |

$1,800,000 |

$15,300,000 |

$0 |

$0 |

$15,300,000 |

$0 |

$0 |

$0 |

$17,100,000 |

| 2021 |

$1,781,500 |

$0 |

$0 |

$1,781,500 |

$12,755,000 |

$0 |

$0 |

$12,755,000 |

$0 |

$0 |

$0 |

$14,536,500 |

| 2020 |

$1,781,500 |

$0 |

$0 |

$1,781,500 |

$15,320,300 |

$0 |

$0 |

$15,320,300 |

$0 |

$0 |

$0 |

$17,101,800 |

| 2019 |

$1,696,700 |

$0 |

$0 |

$1,696,700 |

$15,131,700 |

$0 |

$0 |

$15,131,700 |

$0 |

$0 |

$0 |

$16,828,400 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2024 |

$233,365.66 |

$0.00 |

$233,365.66 |

$0.00 |

|

|

Click for Payoff

|

010 - LEHI CITY |

| 2023 |

$162,007.10 |

$0.00 |

$162,007.10 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2022 |

$138,817.80 |

$0.00 |

$138,817.80 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2021 |

$141,919.85 |

$0.00 |

$141,919.85 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2020 |

$168,914.48 |

$0.00 |

$168,914.48 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

| 2019 |

$159,886.63 |

$0.00 |

$159,886.63 |

$0.00 |

|

$0.00

|

$0.00 |

010 - LEHI CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 50804-2024 |

07/23/2024 |

07/30/2024 |

ORDIN |

LEHI CITY |

WHOM OF INTEREST |

| 79853-2022 |

06/16/2022 |

07/12/2022 |

J F CON |

THANKSGIVING POINT DEVELOPMENT LC (ET AL) |

UTAH DEPARTMENT OF TRANSPORTATION |

| 91835-2018 |

07/06/2018 |

09/25/2018 |

AGR |

THANKSGIVING POINT DEVELOPMENT COMPANY LC BY (ET AL) |

LEHI CITY CORPORATION |

| 91822-2018 |

08/27/2018 |

09/25/2018 |

S PLAT |

LEHI CITY CORPORATION (ET AL) |

THANKSGIVING POINT PLAT G AMENDED |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 11/28/2024 6:10:56 PM |