Property Information

mobile view

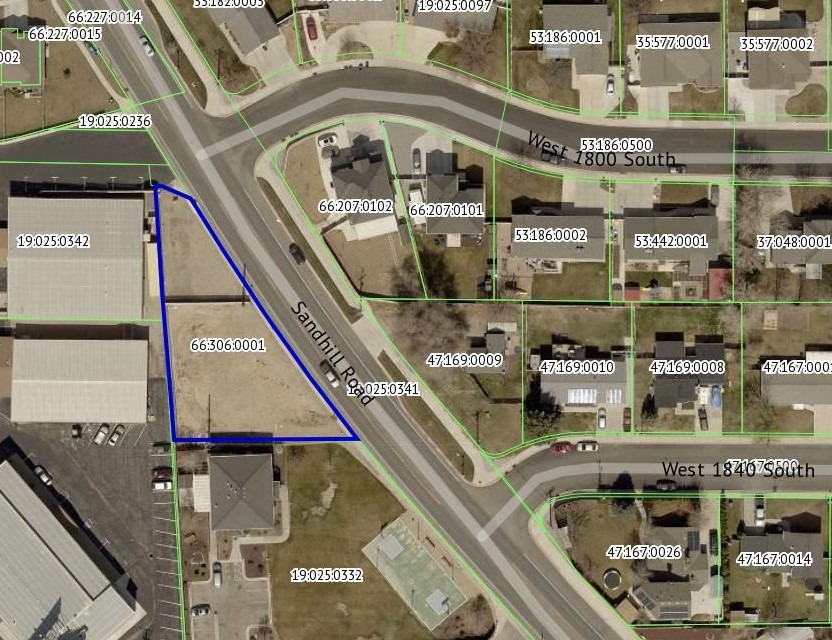

| Serial Number: 66:306:0001 |

Serial Life: 2010... |

|

|

Total Photos: 4

Total Photos: 4

|

| |

|

|

| Property Address: 1824 S SANDHILL RD - OREM |

|

| Mailing Address: PO BOX 970730 OREM, UT 84097-0730 |

|

| Acreage: 0.330514 |

|

| Last Document:

39595-2011

|

|

| Subdivision Map Filing |

|

| Taxing Description:

LOT 1, PLAT A, SANDHILL SUB AREA 0.331 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$143,100 |

$0 |

$0 |

$143,100 |

$800 |

$0 |

$0 |

$800 |

$0 |

$0 |

$0 |

$143,900 |

| 2023 |

$141,700 |

$0 |

$0 |

$141,700 |

$900 |

$0 |

$0 |

$900 |

$0 |

$0 |

$0 |

$142,600 |

| 2022 |

$140,300 |

$0 |

$0 |

$140,300 |

$2,500 |

$0 |

$0 |

$2,500 |

$0 |

$0 |

$0 |

$142,800 |

| 2021 |

$80,900 |

$0 |

$0 |

$80,900 |

$2,500 |

$0 |

$0 |

$2,500 |

$0 |

$0 |

$0 |

$83,400 |

| 2020 |

$80,900 |

$0 |

$0 |

$80,900 |

$2,500 |

$0 |

$0 |

$2,500 |

$0 |

$0 |

$0 |

$83,400 |

| 2019 |

$75,000 |

$0 |

$0 |

$75,000 |

$3,500 |

$0 |

$0 |

$3,500 |

$0 |

$0 |

$0 |

$78,500 |

| 2018 |

$68,200 |

$0 |

$0 |

$68,200 |

$4,600 |

$0 |

$0 |

$4,600 |

$0 |

$0 |

$0 |

$72,800 |

| 2017 |

$65,100 |

$0 |

$0 |

$65,100 |

$4,600 |

$0 |

$0 |

$4,600 |

$0 |

$0 |

$0 |

$69,700 |

| 2016 |

$62,100 |

$0 |

$0 |

$62,100 |

$6,000 |

$0 |

$0 |

$6,000 |

$0 |

$0 |

$0 |

$68,100 |

| 2015 |

$17,500 |

$0 |

$0 |

$17,500 |

$6,000 |

$0 |

$0 |

$6,000 |

$0 |

$0 |

$0 |

$23,500 |

| 2014 |

$17,500 |

$0 |

$0 |

$17,500 |

$6,000 |

$0 |

$0 |

$6,000 |

$0 |

$0 |

$0 |

$23,500 |

| 2013 |

$15,900 |

$0 |

$0 |

$15,900 |

$6,000 |

$0 |

$0 |

$6,000 |

$0 |

$0 |

$0 |

$21,900 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2024 |

$1,176.81 |

$0.00 |

$1,176.81 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2023 |

$1,085.04 |

$0.00 |

$1,085.04 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2022 |

$1,121.55 |

$0.00 |

$1,121.55 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2021 |

$786.30 |

$0.00 |

$786.30 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2020 |

$800.06 |

$0.00 |

$800.06 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2019 |

$724.16 |

$0.00 |

$724.16 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2018 |

$702.88 |

$0.00 |

$702.88 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2017 |

$690.94 |

$0.00 |

$690.94 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2016 |

$732.08 |

$0.00 |

$732.08 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2015 |

$267.12 |

$0.00 |

$267.12 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2014 |

$268.35 |

$0.00 |

$268.35 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

| 2013 |

$269.68 |

$250.06 |

$519.74 |

$0.00 |

|

$0.00

|

$0.00 |

090 - OREM CITY |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 45804-2012 |

04/06/2012 |

06/04/2012 |

R/W EAS |

STORCO LTD |

PACIFIC CORP DBA (ET AL) |

| 39595-2011 |

05/18/2011 |

05/27/2011 |

QCD |

CITY OF OREM THE |

STORCO LTD |

| 117768-2009 |

11/04/2009 |

11/12/2009 |

S PLAT |

CITY OF OREM |

SANDHILL PLAT A |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 2/20/2025 7:47:50 AM |