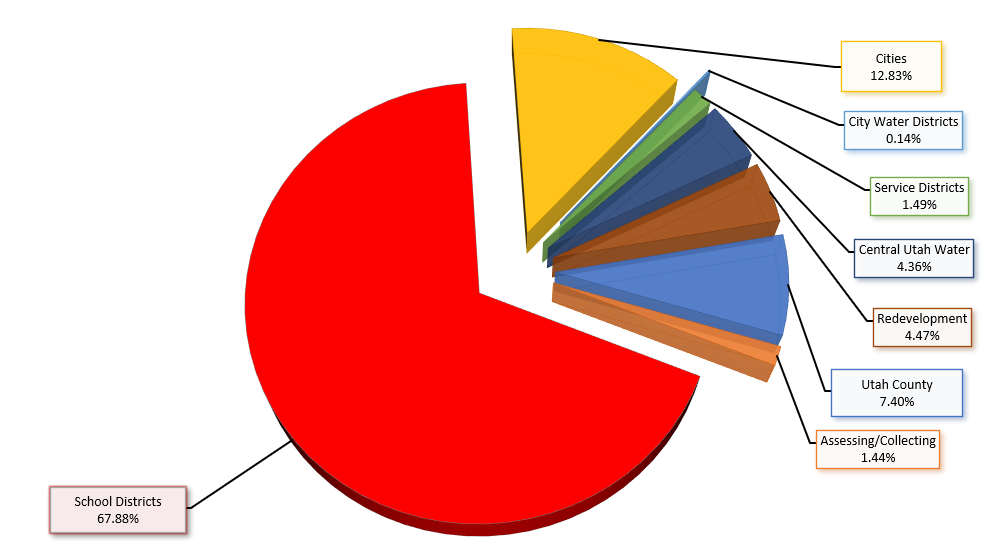

Where Do Your Property Tax Dollars Go?

In 2023, Utah County Residents paid a total of $761,114,148* in Property Taxes. Those taxes were

distributed to the various local governments in the following amounts:

View Distribution Totals By Category

- School Districts

$540,820,745 total tax distributed

67.88% of total tax paid - Cities/Towns

$102,220,226 total tax distributed

12.83% of total tax paid - Utah County

$58,964,502 total tax distributed

7.40% of total tax paid - Redevelopment Agencies

$35,582,106 total tax distributed

4.47% of total tax paid - Central Utah Water District

$34,698,321 total tax distributed

4.36% of total tax paid - Local & State Assessing/Collecting

$11,432,802 total tax distributed

1.44% of total tax paid - Service Districts

$11,847,522 total tax distributed

1.49% of total tax paid - City Water Districts

$1,130,030 total tax distributed

0.14% of total tax paid

*Data is courtesy of the Treasurer 750 report available through the Utah State Tax Commission tax rate website: taxrates.utah.gov

Truth-In-Taxation Summary and Contact List

County Wide Entities

- Utah County

Year of Last Property Tax Rate Increase: 2020

Phone: (801) 851-8000

Website: www.utahcounty.gov Date of Truth-In-Taxation Hearing: 8/15/2024 at 6:00 PM

Public Hearing Information - Multi-County Assessing/Collecting

Year of Last Property Tax Rate Increase: None*

Phone: (801) 297-3600

Website: propertytax.utah.gov - County Assessing/Collecting

Year of Last Property Tax Rate Increase: None*

Phone: (801) 851-8000

Website: www.utahcounty.gov Date of Truth-In-Taxation Hearing: 8/15/2024 at 6:00 PM

Public Hearing Information - Central Utah Water Conservancy District

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 851-8000

Website: www.cuwcd.com

Date of Truth-In-Taxation Hearing: 8/27/2024 at 6:00 PM

Public Hearing Information

School Districts

- Alpine School District

Year of Last Property Tax Rate Increase: 2021

Phone: (801) 851-8000

Website: alpineschools.org

Date of Truth-In-Taxation Hearing: 8/13/2024 at 6:00 PM

Public Hearing Information - Nebo School District

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 354-7400

Website: www.nebo.edu - Provo School District

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 374-4800

Website: provo.edu

Cities & Towns A - E

- Alpine City

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 756-6347

Website: www.alpinecity.org - American Fork City

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 763-3000

Website: www.americanfork.gov - Bluffdale City

Year of Last Property Tax Rate Increase: 2019

Phone: (801) 254-2400

Website: www.bluffdale.gov

- Cedar Fort Town

Year of Last Property Tax Rate Increase: 2007

Phone: (801) 768-2147

Website: www.townofcedarfort.com - Cedar Hills City

Year of Last Property Tax Rate Increase: 2010

Phone: (801) 785-9668

Website: www.cedarhills.org - Draper City

Year of Last Property Tax Rate Increase: 2010

Phone: (801) 576-6500

Website: www.draperutah.gov

Date of Truth-In-Taxation Hearing: 8/15/2024 at 6:00 PM

Public Hearing Information - Eagle Mountain City

Year of Last Property Tax Rate Increase: 2010

Phone: (801) 789-6600

Website: eaglemountaincity.com - Elk Ridge City

Year of Last Property Tax Rate Increase: 2010

Phone: (801) 423-2300

Website: www.elkridgecity.org

Cities & Towns F - O

- Fairfield City

Year of Last Property Tax Rate Increase: None*

Phone: (801) 766-3509

Website: www.fairfieldtown-ut.gov - Genola Town

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 754-5300

Website: www.townofgenola.org

- Goshen Town

Year of Last Property Tax Rate Increase: 2009

Phone: (801) 667-9910

Website: www.goshenutah.org

Date of Truth-In-Taxation Hearing: 8/8/2023 at 6:00 PM

Public Hearing Information - Highland City

Year of Last Property Tax Rate Increase: 2006

Phone: (801) 756-5751

Website: www.highlandcity.org - Lehi City

Year of Last Property Tax Rate Increase: 2022

Phone: (385) 201-1000

Website: www.lehi-ut.gov

Date of Truth-In-Taxation Hearing: 8/20/2024 at 6:00 PM

Public Hearing Information - Lindon City

Year of Last Property Tax Rate Increase: 2009

Phone: (801) 785-5043

Website: www.lindon.gov - Mapleton City

Year of Last Property Tax Rate Increase: 2017

Phone: (801) 489-5655

Website: www.mapleton.org - Orem City

Year of Last Property Tax Rate Increase: 2019

Phone: (801) 229-7000

Website: orem.org

Cities & Towns P - Z

- Payson City

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 465-5200

Website: paysonutah.org

Date of Truth-In-Taxation Hearing: 8/7/2024 at 6:00 PM

Public Hearing Information - Pleasant Grove City

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 785-5045

Website: www.plgrove.org

- Provo City

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 852-6120

Website: www.provo.org

Date of Truth-In-Taxation Hearing: 8/13/2024 at 6:00 PM

Public Hearing Information - Salem City

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 852-6105

Website: www.salemcity.org - Saratoga Springs City

Year of Last Property Tax Rate Increase: 2010

Phone: (801) 766-9793

Website: www.saratogasprings-ut.gov - Santaquin City

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 754-3211

Website: www.santaquin.org

- Spanish Fork City

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 804-4500

Website: www.spanishfork.org - Springville City

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 489-2700

Website: www.springville.org

Date of Truth-In-Taxation Hearing: 8/20/2024 at 7:00 PM

Public Hearing Information - Vineyard City

Year of Last Property Tax Rate Increase: 2003

Phone: (801) 226-1929

Website: www.vineyardutah.org

Date of Truth-In-Taxation Hearing: 8/14/2024 at 6:00 PM

Public Hearing Information - Woodland Hills City

Year of Last Property Tax Rate Increase: 2023

Phone: (801) 423-3900

Website: www.woodlandhills-ut.gov

City Water Districts

- Jordan Valley Water Conservancy District

Year of Last Property Tax Rate Increase: 2018

Phone: (801) 565-4300

Website: jvwcd.org

Date of Truth-In-Taxation Hearing: 8/19/2023 at 6:00 PM

Public Hearing Information - Lehi Metropolian Water District

Year of Last Property Tax Rate Increase: None*

Phone: (385) 201-1000

Website: www.lehi-ut.gov - North Utah County Water Conservancy District

Year of Last Property Tax Rate Increase: None*

Phone: (801) 851-8000

Website: www.utahcounty.gov/NUCWCD/ - Orem Metropolian Water District

Year of Last Property Tax Rate Increase: None*

Phone: (801) 229-7000

Website: orem.org

Special Service Districts

- Benjamin Cemetery District

Year of Last Property Tax Rate Increase: 2001

Phone: None Listed

Website: None Listed - North Fork Special Service District

Year of Last Property Tax Rate Increase: None*

Phone: (801) 225-7263

Website: nfssd.org - Pole Canyon Local District

Year of Last Property Tax Rate Increase: None*

Phone: None Listed

Website: None Listed - Jordan Basin Improvement District

Year of Last Property Tax Rate Increase: 2002

Phone: (801) 571-1166

Website: www.svsewer.com - Soldier Summit Special Service District

Year of Last Property Tax Rate Increase: None*

Phone: (801) 851-8000

Website: www.utahcounty.gov - Springville Drainage District

Year of Last Property Tax Rate Increase: None*

Phone: (801) 491-2985

Website: None Listed - Traverse Ridge Special Service District

Year of Last Property Tax Rate Increase: 2022

Phone: (801) 576-6502

Website: www.draperutah.gov - Unified Fire District

Year of Last Property Tax Rate Increase: 2024

Phone: (801) 743-7200

Website: unifiedfire.org

- Utah County Service #6

Year of Last Property Tax Rate Increase: 2009

Phone: (801) 851-8000

Website: www.utahcounty.gov - Utah County Service #7

Year of Last Property Tax Rate Increase: 2009

Phone: (801) 851-8000

Website: www.utahcounty.gov - Utah County Service #8

Year of Last Property Tax Rate Increase: 2009

Phone: (801) 851-8000

Website: www.utahcounty.gov - Utah County Service #9

Year of Last Property Tax Rate Increase: 2009

Phone: (801) 851-8000

Website: www.utahcounty.gov

*Year of last tax rate increase for years 2000 to present due to Truth-In-Taxation only. Tax rate increases due to judgement levies, voter approved bonds, or other adjustments that did not require a public hearing are not included.